We are glad to introduce a new guest author, B Krishnakumar, to our readers and subscribers. He is an eminent analyst with over two decades of experience and he will be writing on sectors and indices from a technical analysts’ standpoint. We believe the fundamental analyses that we do here at PrimeInvestor will be well supplemented by this different perspective and will give a useful sense of market direction.

B Krishnakumar is an investor / trader with an experience of over two decades in technical analysis. He is a Senior Analyst with Definedge Solutions. Prior to Definedge, he was with FundsIndia, Dow Jones Newswires and The Hindu Business Line.

Krishnakumar is known for his well-timed calls on sectors and indices.

As the Nifty scales new highs, there are specific sectors that are outperforming the index. In a rally such as the present one, if you have a positive outlook on the broad markets, it makes sense to focus on these sectors than look for contrary picks.

Sectors in the outperforming category include the likes of Nifty Bank, Nifty Realty, Nifty Services Sector and Nifty Metal. Specifically, Nifty Financial Services, Nifty Realty and Nifty Metals have been outperforming the Nifty 50 index for a while now whereas the Nifty Bank index has started its outperformance more recently.

Methodology

Before we get into details of these sectors let us briefly explain the methodology used to identify outperforming and under-performing sectors. To begin with, the focus is on the 20-odd sectoral indices, for which data is available from the NSE. The Nifty 50 index is used as the benchmark for the relative strength or ratio analysis.

A sector would be considered an outperformer when:

- The ratio chart (Sector index / Nifty 50) trades above its 50-day and 200-day moving average

- The 50-day moving average is higher than its 200-day moving average in ratio chart

- The ratio chart line is sloping upwards

The rules are just the opposite to identify underperformers.

When all the above three criteria are met, the sector is considered as a strong outperformer. There will be occasions when the ratio chart will meet the first two conditions but the ratio line could be declining. This suggests the start of a temporary underperformance phase.

A sector would get into the outperformance cycle from underperformance cycle when:

- The 50-day moving average crosses the 200-day moving average in the ratio chart (sector index / Nifty 50)

There can be instances where the price in the ratio chart is trading below its 50-day moving average but above the 200-day moving average. In such a scenario, it indicates temporary underperformance of the sector. The outperformance would resume when the ratio chart moves above its 50-day moving average.

IMPORTANT NOTE: Outlook or strategies mentioned in this column are NOT Prime recommendations. For those of you who track markets or follow technicals, this will prove a valuable source of understanding charts and trends in index movements, supplement your fundamental stock decision-making and help you time investment opportunities.

This column will not have individual stock recommendations nor will the author answer any queries relating to stock recommendations. Responses by the author will be restricted to blog comments on the subject written about. The PrimeInvestor team will also not handle any questions regarding this.

Nifty Metals index

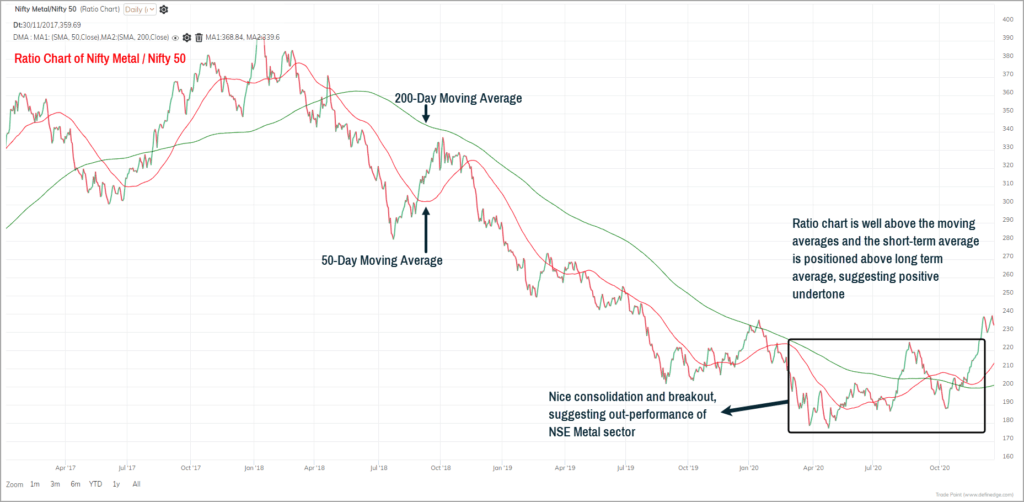

Have a look at the ratio chart of the Nifty Metals index versus the Nifty 50 featured below (click on the image to enlarge):

To understand the importance of ratio chart or relative strength study, also look at the table featured below which captures the point-to-point returns of the stocks from the metals sector. The returns are for the period September 15, 2020 to December 18, 2020. The 50-day moving average of the ratio chart crossed over, above the 200-Day moving average on September 14, 2020. Hence, the performance from the day after – till date is highlighted in the table.

While the Nifty 50 index has gained close to 20% during this period, look at the performance of the stocks from the Metals sector. Large-cap metal names such as Tata Steel, and Hindalco have gained about 56% and 41% respectively, which is far higher than what Nifty 50 delivered.

Nifty Metals and Nifty Bank appear to be in their early stages of outperformance cycle and this trend typically lasts for a while. Nifty Realty Index is a dark horse and could turn out to be an interesting sector to focus on, going forward. The 50-day moving average has just crossed above the 200-day moving average in the ratio chart of Nifty Realty versus Nifty 50.

Temporary blips but sectors to watch out

We mentioned in our methodology that some charts may slip into zones of temporary underperformance. Nifty IT, Nifty Auto and Nifty Pharma are at this stage. They were outperforming the Nifty 50 until few months ago but turned relative underperformers over the last few weeks.

In their respective ratio charts, all the three indices listed above have slipped below their 50-day moving average. These sectors would warrant attention when there is a crossover above the 50-day moving average in their ratio charts.

You may want to keep tab of these sectors. Any sign of recovery would make them outperformers. I will of course be following up on this.

The dark horse candidates include Nifty PSU Banks and Nifty CPSE. Both these sectors have started to look promising over the last few weeks but it would be advisable to wait for signs of sustained improvement in the ratio chart.

Underperformers

The underperforming sectors include the likes of Nifty FMCG, Nifty MNC, Nifty Consumption and Nifty Infra. As mentioned earlier, if you are positive about a broad market outperformance (the outlook for the market will be provided in my next column) then these are sectors to be avoided until there are signs of a turnaround in the relative performance metric of these indices.

Nifty Energy is showing signs of relative underperformance recently although it was showing promise few months ago. This sector is in neutral category for now. Avoid this sector until there are fresh signs of outperformance.

Summary

- Current outperformers: Nifty Realty, Nifty Metal, Nifty Services Sector and Nifty Bank are currently outperforming the benchmark Nifty 50 index. Focus on the stocks from these sectors and look for fresh buy signals to add stocks from these sectors to your portfolio.

- Prospective candidates: Nifty Auto, Nifty Pharma and Nifty IT could be prospective candidates to resume outperformance. Wait for a crossover of the ratio line above the 50-day moving average in the respective ratio chart before taking exposure in these sectors.

- Underperformers: Nifty FMCG, Nifty Consumption, Nifty MNC & Nifty Infra sectors are underperformers and can be avoided for the time being.

- Neutral: Nifty Energy is in neutral zone and can be avoided for now. Wait for fresh signs of outperformance.

- Dark horses: The dark horse candidates include Nifty PSU Banks and Nifty CPSE. But wait for sustained improvement in ratio chart before entering.

Please note that the sector outlook provided here is not a long-term one. I will be updating this every month or as warranted, based on what the charts say.

The views expressed in this column are personal. The view expressed in this post is not meant to be nor should it be construed as a trading / investment advice. Neither PrimeInvestor nor the columnist are responsible or liable for investment decisions based on this view. Consult an advisor for your financial decisions.

Also read : Our Nifty analysis as on 7th March