A long-forgotten sector that has made a big comeback in the most recent leg of India’s bull market is the textile sector. The rally was pretty hard to miss. The stock price of KPR Mills has more than doubled from July 2021 to January 2022 while Vardhman Textiles and Welspun surged over 60%. AK Spintex, a textile stock that has flown under the radar for a while, climbed nearly 190% in just the first two weeks of the new year, leaving many baffled. One-year stock returns have been in excess of 100% for many players. Here are the absolute stock returns on a few textile sector stocks.

But why did textile sector stocks – among the oldest listed sectors in India – suddenly turn blue-eyed boys of the market? Has the sector been fired up by any fundamental changes? We try to answer this question in this analysis.

That India is a force to reckon with in the global apparel and textile sector is well-known. This sector is the largest employment provider in India next only to agriculture, providing direct employment to 45 million people. The sector also contributes to 12% of the country’s export earnings. Blessed with raw material (cotton, jute, silk) and manpower, the sector has a long history and has always been a significant part of the economy and includes an unorganized portion (handlooms, handicrafts, sericulture etc), that India is well known for.

Key textile sector players in India derive a significant portion of revenue from exports. Over 60% of turnover for Nitin Spinners, a yarn focused company, is export business. Ambika Cotton which specializes in cotton yarn and fabric too has a similar proportion. Home textiles majors such as Welspun, Indo Count and Himatsingka Seide have always been export-focused and derive a majority of their revenue from the US, Europe and UK. Apparel exporters too are primarily export driven. S P Apparel, which focuses on infant and kid’s wear, derives ~80% of its revenue from exports. KPR Mill, currently a darling of the market, derives around 30% to 35% of its revenue from exports.

This article focuses on the listed players in the organized portion of the apparel and textile sector.

(The companies mentioned in this article are for illustrative purposes only and are not our recommendations.)

Here are some factors that have fired up the sector in recent times.

China’s loss is India’s gain

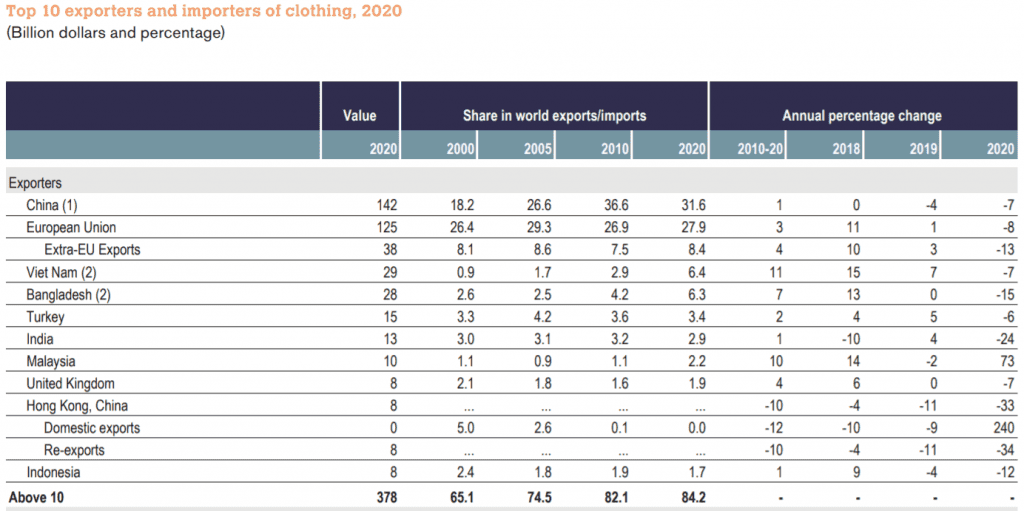

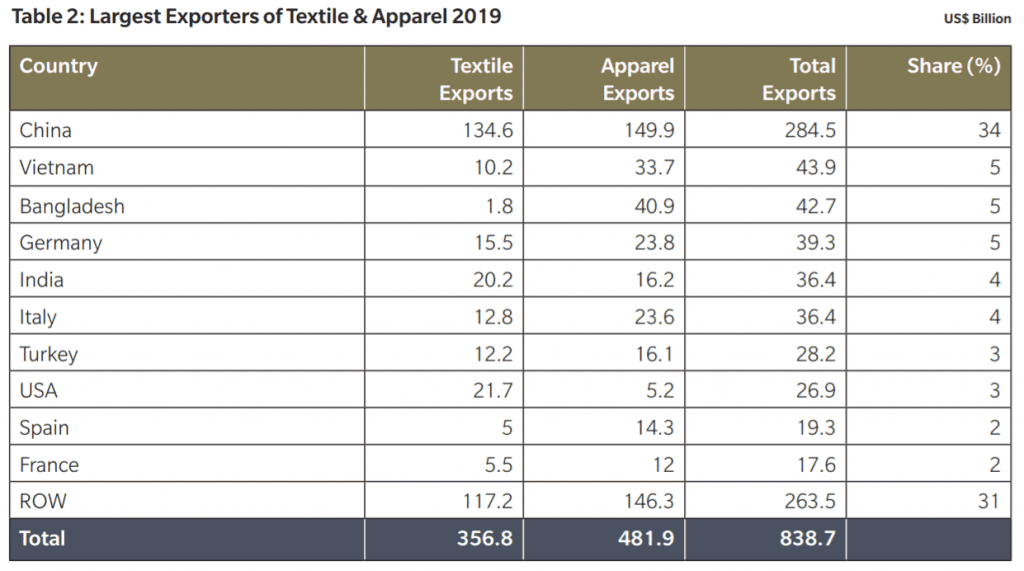

Going by the World Trade Statistical Review 2021, China has undisputedly dominated in the export of textiles and clothing in recent years, but this could be set for a change. Spurred by geo-political tensions (US-China trade war), there has been an increasing adoption of the ‘China plus one’ strategy which has businesses in Western markets diversifying away from China to reduce their dependence on it. The pandemic has exacerbated matters, raising questions over how long China can remain the ‘world’s factory’.

Source: WTO - World Trade Statistical Review 2021

China, the world’s largest producer of cotton yarn and the second largest producer of cotton, has come under fire due to concerns of human rights violations in the Xinjiang region which produces about 80% of China’s cotton. What started out as sanctions on some cotton suppliers from the Xinjiang region in 2020, has turned into a full-fledged ban on goods from Xinjiang. With this ban constraining supplies, demand for cotton based products, mainly cotton and cotton yarn is being met by the rest of the world.

Indian textile sector players have been naturally well-placed to benefit from this opportunity. With Chinese supplies shrinking, new markets have opened up not just for Indian readymade garments players but also for cotton and yarn makers to supply to other apparel and fabric exporting nations such as Vietnam and Bangladesh.

Wider yarn-cotton spreads

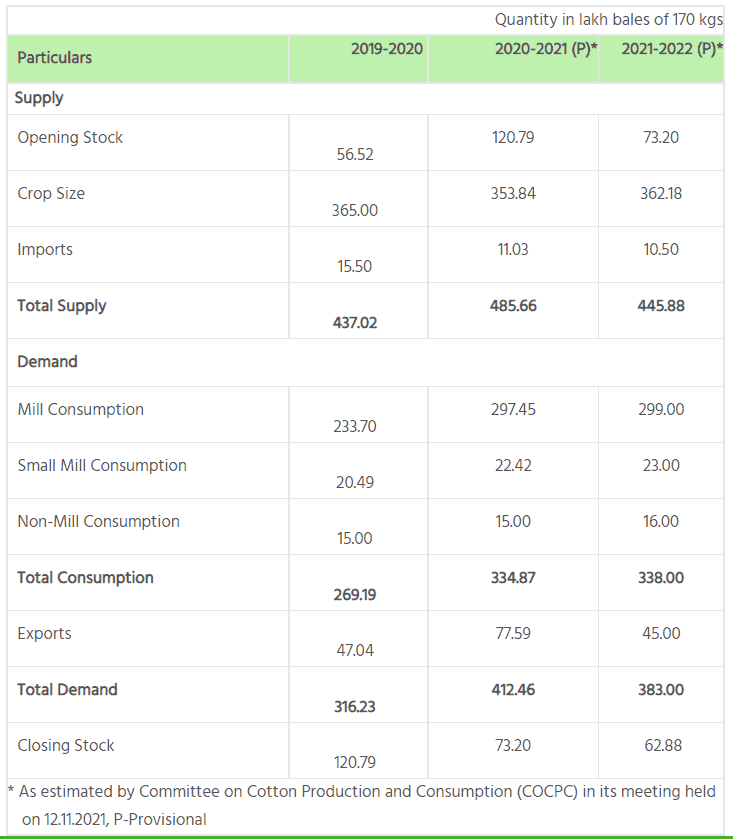

The shift of some of the demand away from China however has not benefited all segments of the Indian textile and apparel sector equally. Based on company annual reports, makers of cotton and cotton yarn have seen the most benefits from this shift. India has a competitive advantage in the abundant availability of cotton, a prime raw material. India accounts for around 20% of the world production of cotton. Though the per hectare yield in India is lower than the world average, India has seen significant improvement in its output to turn largely self-sufficient in cotton and imports only a small quantity.

Source: The Cotton Corporation of India

The Government announces minimum support prices (MSP) for each cotton year (October to September) in order to protect the interests of the farmers and prevent distress sales. In case the prices fall below the MSP, the Cotton Corporation of India (CCI) intervenes and undertakes price support operations. While in the last two seasons, the CCI had to intervene, it expects that in the current season, the prices will stay well above the MSP without intervention. Supply is under pressure due to rain related damage of some crops, concerns over pest attacks, and duty that cotton imports are subject to.

Meanwhile demand remains strong. Globally too the supply side is under pressure due to logistical issues, lower expected production from India and US (US Department of Agriculture lowered US production and ending stock estimates for CY 2021-22). This imbalance has driven up prices for raw cotton and all its derivatives. Yarn prices historically have tended to move in step with cotton prices. In 2012, when cotton prices rose to all-time highs they could not be passed on to customers due to lack of sufficient demand.

Spinning mills with more yarn focused businesses were more adversely affected leading many to shut down or restructure debt that could not be serviced. But this time has truly been different. Increased demand for Indian yarn and a strong rise in global yarn demand (owing to the ban on cotton from the Xinjiang region), have resulted in wider yarn-cotton spreads. This has resulted in an unusual scenario of rising margins for yarn focused players, despite escalating input prices.

Vardhman Textiles, which has the largest spindle count in the country with 11.29 lakh spindles, produces a wide range of specialized yarns. While it has moved up the value chain, it still derives over 60% of its revenue from its yarn business. For the quarter ending September 2021, PBIDT margin was an enviable 28% as against the pre-pandemic scenario when it had stood at under 20%. A similar trend is evident in the margins of Nitin Spinners and Ambika Cotton.

While cotton-yarn spreads are attractive at the moment, and this is benefitting yarn-focused players, it is unclear if this is sustainable in the long term once imbalances between demand and supply get corrected. Integrated players however, seem to be more insulated from fluctuating yarn prices and these could be better long term bets.

Net Sales of Key Yarn Players

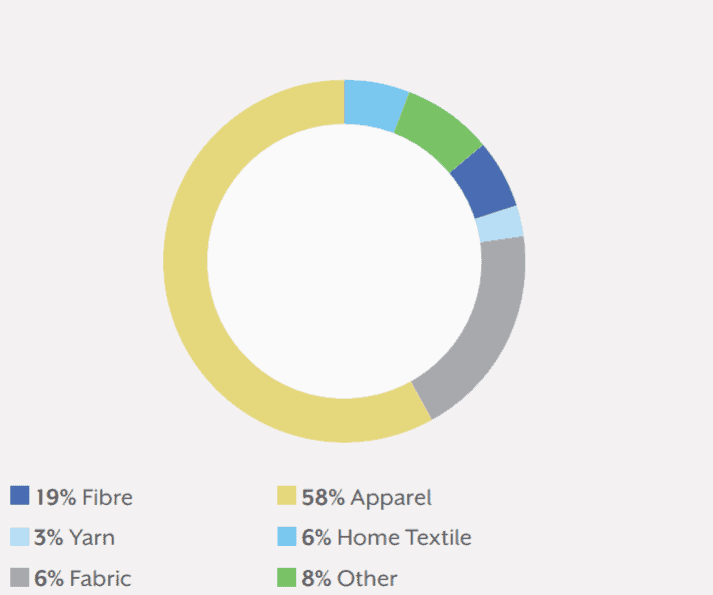

In contrast, Indian readymade garments players have not seen significant benefits yet. The ready-made garments segment accounts for the largest share (and most value-added segment) of the global textile and apparel trade. In this segment, though China has been losing market share since 2015, the business has not flown to India, with most of it captured by Bangladesh and Vietnam (as seen from the data from WTO data above). Given the relatively low share that India commands in the value-added readymade garments space, established apparel exporters such as KPR Mill and Gokaldas Exports have garnered a lot of stock market attention, for their large addressable opportunity.

Source : Welspun Annual report FY 21 – Global textile and apparel trade 2019

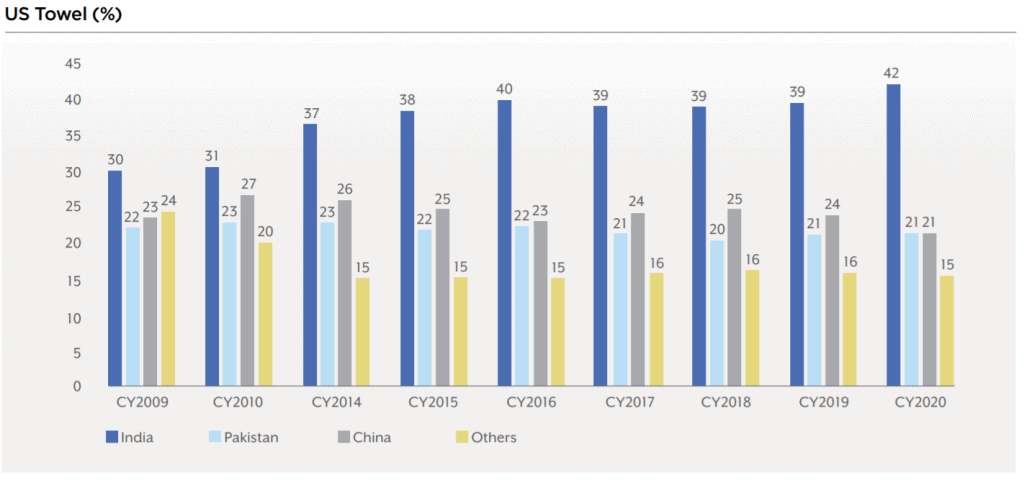

In the smaller home textiles space, India is an established player commanding a leadership position as far as the US market goes. In this segment, the drop seen in China’s share could more logically flow to India, given its position as a preferred supplier. In Europe however, Indian exporters are hindered by unfavourable tariff rates and trade talks could unlock some opportunities there. This sector also saw a quicker recovery after the pandemic as lockdowns and work from home saw people spend on this segment. Further, many big box retailers that Indian exporters supply to, were able to stay open during lockdowns.

Source: Welspun Annual report FY 21

Source: Himatsingka Seide Annual Report FY21

Friendly government policies

Besides the optimism surrounding the sector, the government has been a big cheerleader of the textile sector demonstrated through several initiatives. The main ones are:

PM-MITRA: The Ministry of Textiles announced the setting up of 7 textile parks under the PM-MITRA (Pradhan Mantri Mega Integrated Textile Region and Apparel Parks) scheme to spur technological advancement and attract investments into the textile sector while also integrating the entire value chain in one location to alleviate logistical pressures and costs.

PLI scheme: The Production Linked Incentive (PLI) Scheme for the textile sector has a clear focus on expanding the MMF (man-made fiber) apparel & fabric and Technical Textiles segments and projects that enhance the value of fibre or yarn. Under the scheme, incentives worth Rs 10,683 crore will be provided over five years for manufacturing man-made fabrics, garments and technical textiles. To avail of the incentives, the companies will have to make minimum investments in plant, machinery, equipment and civil works. After a gestation period of two years, minimum turnover requirements will have to be met based on which incentives will be paid out.

NTTM: The National Technical Textiles Mission seeks to promote the technical textile sector with an outlay of Rs. 1,480 crore to promote all aspects of the space, including promoting exports.

RoSCTL scheme: The Government has set a target of USD 100 billion for exports from the textile sector in the next five years. So it is only fitting that the continuation of the RoSCTL scheme (Rebate of State and Central Taxes and Levies) for apparel / garments and made-ups till 2024 was approved. This scheme gives reimbursements of state and central taxes and levies on outward shipments in the form of transferable duty credit scrips to exporters which can be used against customs duty to be paid by the exporters on anything they import (a large part of textile machinery has to be imported). The maximum rebate under RoSCTL is 6.05% for apparel and 8.2% for made ups.

There is an increasing use of man-made fibers, especially as blends with cotton due to their utility and cost and here to China leads. The technical textiles (products engineered for a specific functionality) have seen a surge in demand in the form of PPE suits and other similar equipment in the wake of the pandemic. The PLI scheme and the NTTM will specifically provide a push to these two sectors.

Apart from the above, ATUFS (Amended Technology Upgradation Fund Scheme) launched in 1999 has been around in some form (TUFS) or other and reimburses subsidy claims on eligible capital investments. Further, 100% FDI is allowed under the automatic route.

Loose ends

Absence of FTAs with key markets: What does not help with promoting exports is the absence of FTAs with the key markets that the sector exports to. Customers are price sensitive and the duties faced by Indian exporters in key markets as against the status enjoyed by other countries (such as Bangladesh, Vietnam and Cambodia) works against them. Various industry associations have been lobbying for Trade Agreements with the major export destinations for textiles (US, EU and the UK). With talks commencing with the UK and aiming (ambitiously) to close by the end of the year, there is a certain degree of measured optimism that FTAs could be in the offing in the medium term.

Handling of duty inversion: The domestic textile sector suffers from an inverted duty structure and to correct this, a uniform GST rate of 12% was proposed and was to come into effect on January 1, 2022. This would have meant more money out of the customer’s pocket. Encouragingly, this move was deferred by the GST Council on the back of concerns raised by several states and industry associations that it would place additional stress on an industry, giving weight to the belief that the Government intends to support the sector.

What to look for and look out for

For an investor looking to get a piece of the action in the textile sector, the choices can be mind boggling due to the large number of players, the different areas of focus that they bring to the table and the many variables that are at play in the textile sector. Input costs, regulatory environment, exchange rates and logistical challenges can all play havoc with results, not to mention, economic outlook in key markets (US, Europe, UK, China).

- Yarn and fabric focused players may be in a sweet spot, and present an attractive opportunity right now due to the combination of circumstances that is present now. However, it needs to be watched if the wider-than-usual yarn-cotton spreads caused by the mismatch in demand and supply is sustained in the long term. Players with vertically integrated operations that allow them to soften the blow of input costs and are well positioned to take advantage of the export opportunity, seem better long term bets.

- Players in the home textile sector are already leading with a strong presence and relationship with key clients in major markets. Here, major players have completed major capital expenditure programs in the last couple of years and are in the mode of improving capacity utilisation rates and de-leveraging. This offers the main investment case for this segment though Indian players are still small in the global scheme of things.

- Apparel export players with a solid track record seem well positioned to take advantage of the export opportunity with integrated players having an edge. Valuations of integrated textile sector players like KPR mills have already run up a lot, factoring in strong growth in apparel exports sweetened by exposure to the sugar and ethanol business. Gokaldas Exports too is in a similar position on the back of debt reduction and change in management.

- In the past, the textile sector has often been in the news for working capital issues and high rates of debt defaults to banks. A healthy balance sheet especially with regard to debt (debt servicing capacity and cash flows) and a clean track record would be invaluable.

1 thought on “Sector analysis: What’s changing in the textile sector?”

Thanks for sharing good information

Comments are closed.