When we launched the Portfolio Review Pro, we knew, through our years of experience with investors, that you needed to review not just your portfolio, but your family’s as well. We had therefore started work on this front soon after launch. And the feedback from many of you post the tool launch only confirmed this requirement.

And here we are now, ready with the NEW ‘My Family’s Portfolio’ feature in our Portfolio Review Pro tool which we believe is the best mutual fund review tool out there. With this new feature, you can now add up to 4 more PANs to your Portfolio Review Pro.

We had launched this feature about a couple of weeks ago, and many of you have begun using it as well. In this blog, we’ll explain all that you can do with this feature, how to get the most out of it, and how you can go about adding PANs in Portfolio Review Pro.

The Portfolio Review Pro is your solution to disciplined, unbiased and holistic review of your mutual fund portfolio. When we launched this one-of-a-kind product, we knew we were going miles ahead of the market – where most of the ‘insights’ offered were in reality, just loads of data. But with Portfolio Review, we ensured that we bundled these data into meaningful insights and action needed. We did this by letting you know how your portfolio performs beyond just the absolute returns, your portfolio’s quality, risk, asset allocation, concentration & expenses.

What the ‘My Family’s Portfolio’ is about

The Portfolio Review Pro uses your PAN and phone number to fetch (or update) your mutual fund holdings. Up until now, you could use only one PAN per subscription. Now, many of you could be managing investments of your spouse, or children or parents. The new feature will now help you review your family’s portfolio in the most holistic way possible, ensuring you do not miss out on reviewing the rest of your family’s investments – either individually or by clubbing them.

You will now have one primary PAN – which you may already be using in the tool. This is shown under the tab My Portfolio in the Review Pro. This would be the first PAN you added in your Review Pro tool.

Now, under the ‘My Family’s Portfolio’ tab, you can add four more PANs (we’ll explain how later in this blog) and do all that you currently do in the Review Pro with these added PANs as well. In total, you can have 5 PANs with their respective mutual funds within the Portfolio Review Pro – giving you a single place to manage all your family’s mutual funds.

What the family feature lets you do

Review Pro helps you understand what your portfolio looks like and what can be done to make it even better. Thus, far, you had the following benefits using Review Pro:

- A consolidated view of all your funds you hold, wherever you hold them.

- A snapshot of the main characteristics of your portfolio, from returns to asset allocation, top stocks or sectors held, credit or maturity profile in debt and so on.

- Our research opinion on your portfolio on asset allocation, risk, quality, concentration & expenses.

- Portfolio Health score so you know in a single view whether there’s a complete overhaul needed or just small tweaks will get your portfolio in top shape

NOW, you can do all of this with the multi-PAN feature, too. Here’s explaining it a bit more:

#1 Flexibility in which PAN to view

The new Family Portfolio allows you to choose funds under one or multiple PANs to view and review. If for example, you have a goal for which the investments are made in your name as well as your spouse’s, then you can combine the two PANs together and review. On the other hand, you may want to review your parents’ investments separately.

Therefore, while you can add all their PANs and portfolios in your Review Pro, you can choose which ones to review at a time. Essentially, you have the flexibility to pick any combination of PANs that is required for you to effectively track and manage your investments. This selection can be done in the My Family’s Portfolio tab. Click the arrow in the Family Members section, pick the PANs you want, and then hit ‘Proceed’. This will change the mutual fund details you see in the tool and which you can review.

#2 Flexibility in fund choices for review

We always expound the idea of having a portfolio dedicated for a goal. The Review Pro therefore already allows you to pick specific funds to review as a portfolio. With the multi-PAN feature as well, you can pick whichever funds you have earmarked for a particular portfolio no matter which PAN it is held under.

Here’s an example. Let’s say you and your spouse together invest towards your child’s education. So, some funds in this education portfolio could be held under your PAN while the others are with your spouse. Now you want to review this education portfolio. here’s what you can do:

- In the Review Pro, go to My Family’s Portfolio.

- Select yours and your spouse’s PAN. Next, hit Review My Funds.

- Then pick the relevant funds held under yours and your spouse’s PAN. Enter the portfolio details such as risk and timeframe. Then hit Review and voila!

- Your education portfolio review is done!

Simply put, you can choose some funds in one PAN and other funds in another PAN and get them reviewed. You don’t need to select all the funds. You can choose the ones you have ear-marked for a goal whichever PAN they come under. The portfolio review insights will still put it together and provide a health score and action needed.

#3 Download and analyse all you want

Once your review is done, the entire review output along with the portfolio characteristics can be downloaded into an Excel sheet. This includes the asset allocation break up, top stocks/sectors, maturity profile and so on. You will also get the PAN-wise details of each fund including invested & current value and returns. Finally, all insights in the Review Pro on Prime Ratings, buy/sell/hold calls, reasoning for the call, concentration risk, high-cost regular plans, and so on will also be available against each fund.

This makes it easy for you to do any further analysis that may be needed, such as identifying how much to redeem to bring asset allocation back in line or which funds held under which PAN can be consolidated and so on. It also lets you keep them as record and refer to the review easily.

How to add PANs in the best mutual fund review tool

Now let’s get to the more procedural aspect of this feature.

Primary PAN: As mentioned above, you have one ‘primary’ PAN which you will always see in the Review Pro, in the first tab. This is the first PAN that you use in the Review Pro and this cannot be changed. Therefore, choose wisely, if you are a new user of Review Pro😊A primary PAN will always be part of your subscription and you have absolutely no additional charges here.

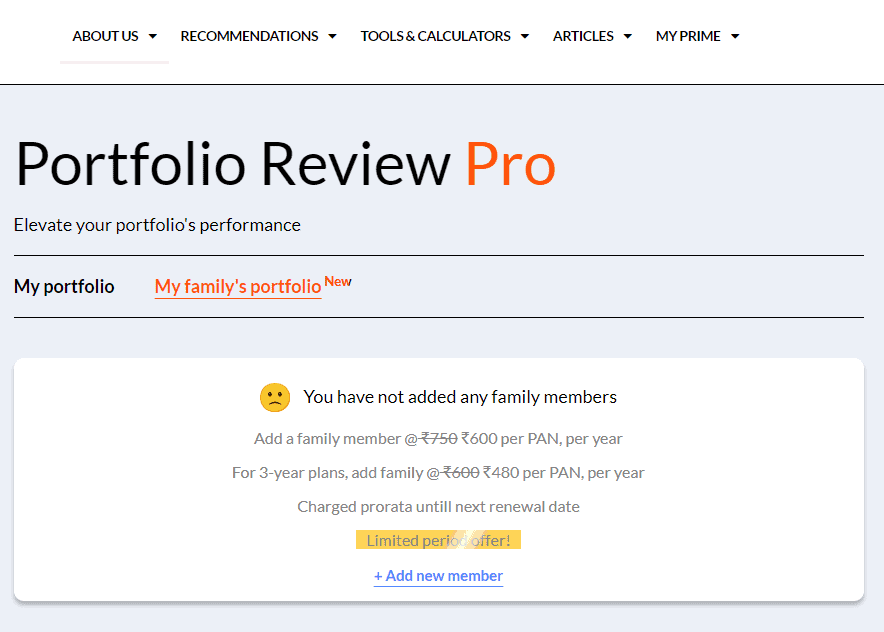

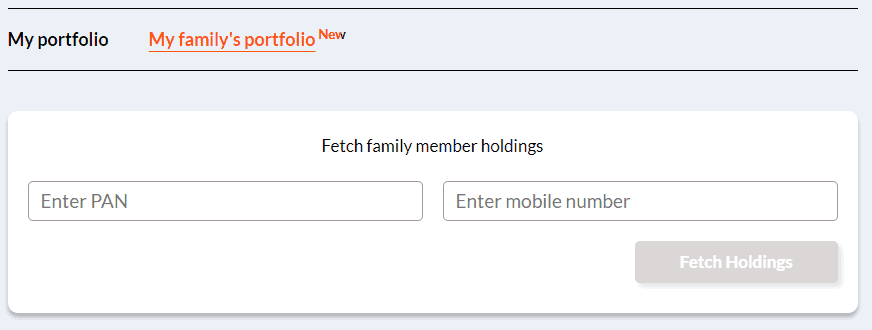

Family PAN: The second tab – called My Family’s Portfolio – is where you can add your family members’ PAN and undertake all the selection, tracking and reviews explained above. Click on ‘Add New Member’ to add the new PANs.

For each PAN that you add, you will need to pay a small additional fee of Rs 750 per year (Rs 600 per PAN if you’re on the 3-year plan, Growth or Essentials). GST applies additionally.

This fee is calculated depending on how many months you have left in your current PrimeInvestor subscription; any PAN slot you are buying in Review Pro is always linked to the period of your subscription. For example, if you are on a 1-year Growth plan and there are 6 months left in your subscription, you will have to pay Rs 300 for adding a PAN.

We tie your PAN additions to your subscription validity because you need an active PrimeInvestor subscription in order to use the Review Pro.

P.S. As a launch offer, we’re giving a straight 20% discount on adding a PAN. You need to pay only Rs 600 per PAN if you’re on a 1-year plan and just Rs 480 per PAN if you have a 3-year subscription.

Once you buy a PAN slot, enter the PAN and phone number (and OTP) to fetch the mutual funds linked to that PAN/phone combination. As you may already know if you have used Review Pro earlier, you need to enter your PAN only once. After that, you can return to Portfolio Review Pro at any time to view/review; most data such as asset allocation, market cap allocation, current value, and the review section etc. is updated on a daily basis. So the value you will see will be the latest!

But please note the following:

- You need to refresh your fund holdings details if you have made any fresh transactions (investment or redemption) since the last time you viewed your holdings (we will mention when you refreshed/updated last).

- You will only have to generate an OTP every time you need to do such updates.

- For the Growth plan, such portfolio refresh can be done every day. For the Essentials plan, you can refresh every 2 weeks.

Other important points to note with additional PAN in Review Pro are as follows:

- You cannot change the PAN & details in a slot you have purchased. That is, once you have entered a PAN and fetched the mutual fund details you cannot delete this and replace it with another PAN. You will have to buy a new slot.

- At the time of renewing your PrimeInvestor subscription, you can decide whether or not you want to renew the additional PANs bought as well or any combination of added PANs. If you do not want to continue with a PAN, you can remove it from your cart and proceed with your renewal. You can always come back and buy a new PAN slot at any time you want and enter all details afresh. Remember that your primary PAN (first PAN) will always be part of your PrimeInvestor subscription and when you renew, this will automatically renew as well with no additional charge.

- If you are upgrading your plan from Essentials to Growth, any additional PAN you bought will automatically shift to your new Growth plan (there’s no extra charge of any sort). Upgrading does not affect PAN slot purchases under Portfolio Review Pro. The only thing that changes is the frequency with which you can refresh your portfolio data 😊

- Only PrimeInvestor subscribers can add PANs. If you’re on a trial plan, you will first need to become a subscriber and then add PANs.

- At this time, we do not show combined XIRR for Multi-PANs (on a full portfolio basis or fund basis), as the complexities involved which can slow the product down. We show the absolute gains at all times. XIRR is available when you choose individual PANs. Never say never though! We will always explore ways to make it easier for you to manage your investments.

Why this product will give you an edge

For most of you, managing investment is at a family level, although it is segregated at a PAN level by AMCs, authorities and even your transaction platform. But at PrimeInvestor, we don’t just think about ‘how you invest’. We think about the ‘purpose of your investment’. We want our product to ensure you achieve the purpose for which you set out in the first place. We strongly believe that we have helped you get over this limitation with the new feature.

The family feature in the Review Pro is a one-stop-shop for you keep an eye on your family’s mutual fund investments. It makes it easy for you to:

- Track your entire family’s mutual fund investments, understand how it is performing, what its characteristics are.

- Maintain a family approach to investments, especially where such investments are made by multiple family members

- Use our expert research insights much more effectively and much more suitably, since it covers not just your own funds but your family’s funds as well.

Whether you use the services of an advisor or a relationship manager or simply operate with a DIY platform, we are confident this tool will add value to you and will be a ‘must use’ feature. For those of you who have asked us why we charge for the additional PANs, the response is given below. And for the purpose it serves, we are confident you will find value in the small additional cost.

Why do we charge for each additional PAN?

Simple answer: Because we incur quite a few costs to do the portfolio fetches. Every single time you ‘refresh’ your portfolio for a PAN, it costs us quite a bit to get your portfolio downloaded from the mutual fund registrars (RTAs). To support all the potential refreshes a person can do over the course of a year for every PAN, we need to charge separately for each PAN. And this is not adding the tech cost involved form our side to store and process such data every time.

Also, please note that it costs us the same to fetch your primary (first PAN) too! But when we launched the Portfolio Review Pro product initially, we decided to bear those costs, giving it to you as part of your primary subscription at no extra cost. Beyond a single PAN, it would not be viable for us to offer additional PANs at no additional charge.

This is not the end of feature updates on the Portfolio Review Pro. We have plenty of plans in store and we receive great suggestions from all of you as well! Do take full advantage of this tool and as always, we welcome on your ideas on what you’d like to see.

12 thoughts on “Our mutual fund review tool just got better”

First things first, Multiple PAN support is an excellent addition and simplifies managment of portfolio, thanks to the PI team.

Please extend the portfolio review tool include direct stocks held as well for completeness.

I like your multiple PAN ,features…..

Why don’t take shares data also,apart from mutual funds…

Like NSDL CAS download gives shares and mutual fund holdings together..

A review of it ,is better than only mutual funds review alone..

Regards

CHANDRASEKARAN

Primeinvestor should give an option of receiving the OTP for login by email along with text message. This would be helpful for NRIs.

Am sure there will be lots of suggestions going ahead, but I really wanted to give a shout-out to them team for this incredible tool for DYI folks. I was looking around for automated XIRR tools for long, and this really helps. Even a platform like ICICI Direct did not have such a tool (AFAIK) and hence doesnt give a perf benchmark for my investment actions. Thanks to the entire PrimeInvestor team!

Thank you! – regards, Bhavana

Thank you. Pls show overlap data also.

It is hard to show portfolio overlap data when there are multiple funds in a portfolio, and besides it is useful as a metric only for equity funds. The top stocks and sectors data will give you an understanding of the extent of portfolio overlap; higher concentration in the top stocks means that your funds are likely to have similar portfolios. thanks, Bhavana

Thank you Bhavan. Got it.

Hi Bhavna, this tool is really useful. One more feature I would request to include is the XIRR from the first date one investor started journey at their PAN level. For e.g. if one had invested some amount in 1990 and sold that MF in 2000, that would have generated some returns, but that fund may not appear in the list as of today. This is possible if XIRR is generated since 1990. There are some platforms where this facility is available. I would like this to be part of PRO as well. Kindly consider, thanks

Thanks, sir! We give the XIRR return when you choose a single PAN (primary or when you select one single additional PAN). This XIRR considers all transactions you have made since the beginning, whenever that was. Even if you exit a fund, this transaction and the returns it had generated will be captured in the XIRR. So the XIRR being shown now is as you have requested. Of course, for very old transactions (like 1990 :-))it is subject to transactions being captured by MF Central. It is only when you combine PANs that we do not show XIRR for that combined portfolio. – regards, Bhavana

Thanks for response. Currently in my case portfolio XIRR shows only as of latest one for existing funds. In other Platforms (that I am aware of and using for DIY Funds) fetching portfolio returns since beginning is available. You can consider if this is not cumbersome exercise. Other platforms take portfolio details, including ZERO holding folios, from CAMS. Thanks

As mentioned in the earlier response, the XIRR takes into consideration all transactions even if you have exited a fund and have zero holdings. If you notice that there is an error in your XIRR data, can you please write to us with the details? It will help us check and rectify. – thanks, Bhavana

Comments are closed.