Perpetual bonds have caused some sleepless nights for fund managers after SEBI’s circular earlier this month. On March 10th, SEBI issued a circular capping the debt scheme exposure to perpetual bonds at 10% and also laying down new rules on how these bonds should be valued in debt scheme portfolios. We wrote a short take on it last week suggesting that you wait for clarity. SEBI has now come up with one more circular offering some clarification.

The gist of the matter is this:

- Perpetual bonds don’t have any maturity date. However, they may have a call option where the borrower may opt to repay early on a specific date.

- In India, banks looking to meet Basel III norms and seeking permanent capital to supplement equity, are the main issuers of perpetual bonds – called AT1 bonds or tier 2 bonds. The main feature of such bank perpetual bonds is that they can skip interest payments if the bank’s financials are shaky. Or they can even write off your principal if they are tottering and RBI wants them to absorb losses.

- But because these bonds were seldom written off, or even skipped interest payouts, everyone got used to pretending that they were just like any normal bonds. Though these bonds have no maturity date, these bonds were also valued on yield to call basis. That is, it was assumed that the issuer would exercise the call option. So present value calculations were based on the bond being redeemed 3 years or 5 years, whenever the call option was slated to be exercised. This suited everyone. The bonds paid higher interest than normal bonds but were valued as if they would be repaid in 3-5 years. They were used by many mutual funds to shore up returns. Life was good!

- SEBI did not like retail investors being exposed to these strange bonds and rightly so. After Yes Bank got into trouble and was acquired by SBI, investors were rudely woken up to the fact that the principal on these bonds could be fully written off, leaving them with nothing. MFs holding these bonds had to take NAV hits.

- So, SEBI decided that it better if MFs hold less of these bonds and set exposure limits for each debt scheme at 10%. It also said that the value of these bonds should reflect their risk in terms of duration. It mandated (through a circular on March 10, 2021) that the valuation of these bonds should be done assuming their tenure to be 100 years.

- This wasn’t a big issue for funds that held actively traded perpetual bonds, as they could still be valued at market prices. But thinly traded bonds had to follow the 100-year rule. Effectively, when a bond that you have assumed to be a 5-year bond is now valued as a 100-year bond, its valuation is likely to crash sharply.

- This is why the circular put the MF industry in a tizzy. The Ministry of Finance (as these bonds are a big source of public sector bank funding) got worried about the lack of buyers for future issues and shot off a letter to SEBI to rethink its valuation rules. So SEBI came out with a revised circular on March 22, 2021 to assuage its concerns.

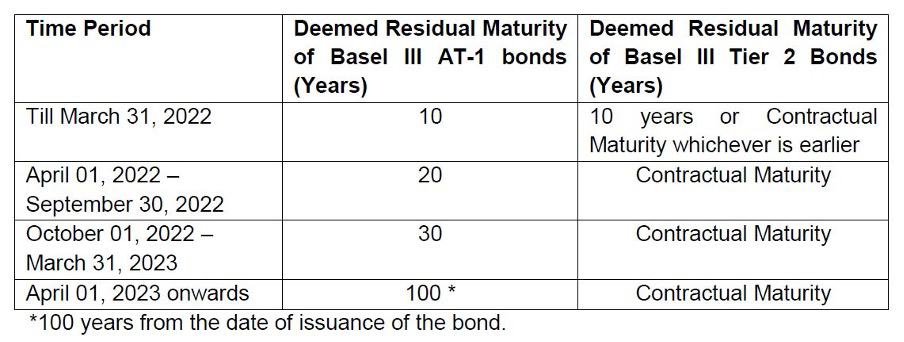

The new circular provides a more phased approach in terms of valuing these bonds. The image below tells you how it is phased out:

Mutual funds that hold these bonds will have to value the bonds based on the above metrics. That means they will need to value thinly traded perpetual bonds as 100 year bonds from April 2023. But they have two years to adjust to this because they can spread their mark downs over 2 years.

A high-risk product

Before we move into the impact, you need to know the nature of this beast. Perpetual bonds because of their features, are very high-risk instruments, best suited to high-net-worth individuals or institutions who understand the risk. This is why SEBI has been discouraging its use in the retail space. And now, SEBI does not want mutual funds to use this instrument in low risk/short term debt funds and has therefore come up with the recent circular.

Please read our earlier article about why perpetual bonds are risky. For those of you who bought perpetual bonds solely based on what your banker told you, we had warned (exactly a year ago), that they are highly unsuitable products for regular income/capital safety.

What is the big deal?

If you hold debt or hybrid funds, there is a fairly high chance that one of your funds will hold perpetual bonds. According to our calculations, about 105 debt and hybrid schemes held about Rs 37,000 crore worth of perpetual bonds as of February 2021 – mostly issued by banks, but a few by companies. So, what happens now?

Just this:

- The new SEBI circular(s) would mean some of your funds will need to reduce their perpetual bond exposure/exit these bonds, either to keep to the 10% limit or because they will end up stretching the fund’s maturity profile too much.

- These bonds will see (or have already seen) mark-to-market (MTM) losses as the SEBI circular now says they must be valued at least as 10-year bonds (which would carry lower value than bonds called in 3 or 5 years) immediately, with the maturity being gradually increased.

So, why should a longer tenure cause a bond’s value to fall? A simplistic explanation would be a longer tenure means more uncertainty on repayment. The asking return (yield) therefore goes up. Since the interest (coupon) is fixed, the price must fall to deliver a higher return (yield) for the same interest. So, you will see bond yields moving up and the prices of these bonds falling.

Let us take this simple example of a SBI perpetual bond that is traded: You will see that the weighted average yields moved up from 7.3% on March 10 (when the first circular came) to 8.2% on March 22. In other words, about a 90-basis point move in yields caused a 3.2% fall in the price of the instrument. So if your fund held, say 5% in this bond, it would have experienced a 0.16% fall in its NAV, due to this instrument alone.

Perpetual bonds – Varying impact

Does it mean that every traded bond will see an equally sharp fall due to this rule? No, bonds may see varying declines based on the probability the market assigns to the issuer exercising the call option at the exercise date. If the market believes a bank is sound enough to exercise the call option 3 years or 5 years hence, its value may not fall much. Sound issuers like HDFC Bank or SBI may thus see their perpetual bond valuations hold up better than say some old private sector banks.

A bond that is lower rated (remember these bonds come with varied rating from AA+ to A-) may be punished more as the uncertainty just increased. If a bank does not exercise its call option, the market may decide to mark down the value of other bonds as well to a longer period. In other words, there is some collective wisdom that goes into market valuations, which may decide the pricing of well-traded perpetual bonds.

Interestingly, some of the mutual funds such as IDBI Dynamic Bond or IDFC Credit Risk, which have very high exposure to perpetual bonds did not see any impact on their NAV thus far from this rule change. (Details are given in the downloadable excel in the ‘Should you exit’ section). This could be because of the high quality or tradability of their holdings.

Ok, the above is an explanation of what happens when the bond is traded. What happens if the perpetual bond is not traded or thinly traded? Mutual funds will need to follow SEBI’s new valuation rules. If the bond had a call option, it will be valued based on lower of the yield to call valuation or the final maturity (for now 10 years) whichever is lower. At this juncture, this would mean valuing at 10 years. So these bonds will likely see an MTM loss.

So, if your debt funds own perpetual bonds, this is what they may do:

- Reduce exposure to ensure they hold not more than 5% of their assets in a single issuer of perpetual bond and 10% in all perpetual bonds put together.

- Sell such bonds in closed-end funds like FMPs

- Reduce exposure so that the AMC at large does not hold more than 10% of the value issued by a single issuer

- Revalue their bonds (From April 1, 2021) to reflect SEBI’s valuation guideline, where the bonds are not traded

Schemes that need to sell perpetual bonds may be forced to sell them at not-so-great prices.

8 thoughts on “What to do if your MF holds perpetual bonds?”

Can you help me to know which are good bonds to invest apart Perpetual Bonds that cab give good returns.

We cover bonds separately, based on available opportunities. It’s always a call on the trade-off between the risk and whether the coupon compensates for it. We do plan on more active recommendations this year, under our Growth plan. You can find our earlier coverage on bonds here: https://staging.primeinvestor.in/category/all-categories/bonds-deposits/ Our deposit recommendations are here: https://staging.primeinvestor.in/prime-deposits/ – thanks, Bhavana

very helpful article, keep up the good job

Thank you! Vidya

Thanks for the timely article, very useful. May I know if the % holdings in the excel file is based on Feb 28 Data released by MFs? I track HDFC short term and ICICI pr savings fund and as per Feb data, HDFC short term has 1060 cr (6.1% of fund) and ICICI pru savings has 3055 cr (10.73% of fund) ; minor discrepancy to what is in your excel file. Thats fine; Also whats your view on ICICI pru savings overall, as per current MF review rating, it has 3.5 rating with “Buy” reco. do you see any issue with the overall quality of the fund?

Data is per ICRA – our data vendors. ICICI Pru – no change bacause of this..our quarterly review will kick in end of this month and will be known 2 weeks into April. Vidya

The excel file is password protected hence unable to sort or filter. 🙁

ONly the top logo area and bottom disclaimer is protected. Please select the data area and use. It is not protected. thanks, Vidya

Comments are closed.