In our article, ‘Critical checks to make on critical illness covers’, we spoke about the need for a good critical illness policy in your insurance arsenal. We also said that rather than opting for a critical illness cover that is tied to your life insurance or your indemnity health plan, a standalone critical illness cover would be the best way to get this protection.

We duly put all the critical illness covers available in the market through some standard filters such as:

- Illnesses covered

- Sum insured offered

- Coverage of pre-existing diseases

- Duration of waiting and survival periods

- Insurer track record

After this exercise, we have shortlisted a set of critical illness plans, which we will start reviewing. We begin with the Activ Secure Critical Illness Plan by Aditya Birla Health Insurance, which we think is a good plan for high-income earners.

Key features

First, the main feature of this policy:

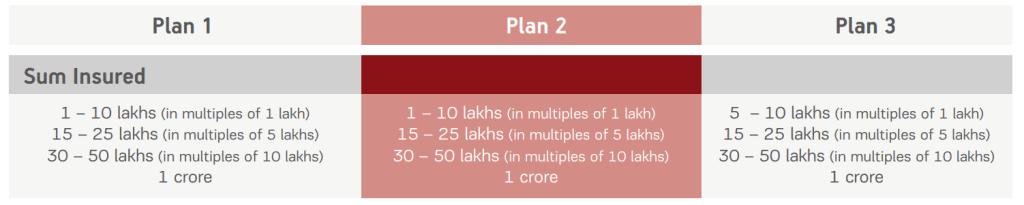

- This policy comes in 3 variants – Plan 1, Plan 2 and Plan 3 that cover 20, 50 and 64 critical illnesses respectively.

- The sum insured can go up to Rs. 1 crore.

- The minimum age on entry is 5 years under Plans 1 and 2 and 18 years under Plan 3.

- While maximum age at entry is 65 years, the policy comes with lifetime renewability without a reduction in sum insured. The premium however, is not locked in.

- The policy is available on an individual and family basis, where each insured person gets an individual sum insured. A 10% discount on premium is available when more than two members of a family sign up.

- The tenures available are 1,2 and 3 years. Signing up for tenures greater than a year, on a single premium basis, will fetch discounts of 7.5% and 10% for 2 and 3 year tenures respectively.

- To avail of this policy’s benefits, you need to be resident in India as per the Income Tax Act, 1961.

- A pre-policy medical exam may be required. Pre-existing diseases that have been declared or detected at the pre-policy medicals and have been accepted will be covered after a waiting period of 48 months.

- The benefit payout on the first detection of one of the listed critical illnesses is subject to a standard waiting period of 90 days after the start of the policy and a minimum survival period of 15 days after the detection of the illness.

- This critical illness policy can be purchased on its own or in combination with one or more of the other covers under the ‘Activ Secure’ umbrella (personal accident, cancer, hospital cash etc.)

What we like

There are a few key aspects to this policy that give it an advantage.

#1 Wide coverage of illnesses

The extensive list of illnesses that this policy covers (especially under Plans 2 and 3) when compared to other critical illness covers available makes this plan stand out. Under Plan 2, the policy covers 50 critical illnesses including Alzheimer’s disease, Parkinson’s disease and Motor Neuron Disease that don’t always find a place in critical illness plans. Plan 3, in addition to the 50 illnesses covered under Plan 2, covers an additional 14 illnesses (known as List B) such as angioplasty, pericardiectomy, keyhole coronary surgery, cardiac pacemaker insertion etc.

But there are caveats. The 14 illnesses are eligible for a payout only at 50% of the sum assured, further capped at Rs. 10 lakhs. They also come with a longer (180 days) waiting period. The entire list of illnesses covered can be found in the Activ Secure Critical illness plan prospectus.

#2 Higher sum insured up to Rs. 1 core

In case of critical illness, you need a cover large enough to not only take care of medical costs but also compensate for loss of income. The table below shows the different levels of sum insured for the 3 plans in the Activ Secure Critical Illness.

Source: Activ Secure Critical Illness plan brochure

With most other products capping sum insured at lower levels – Bajaj Allianz’ Critical Illness policy caps it at Rs. 50 lakhs; Future Generali at Rs. 50 lakhs for customers aged below 45 years and Rs. 20 lakhs for older customers; HDFC ERGO offers a maximum of Rs. 10 lakhs), the Rs. 1 crore sum insured is a plus.

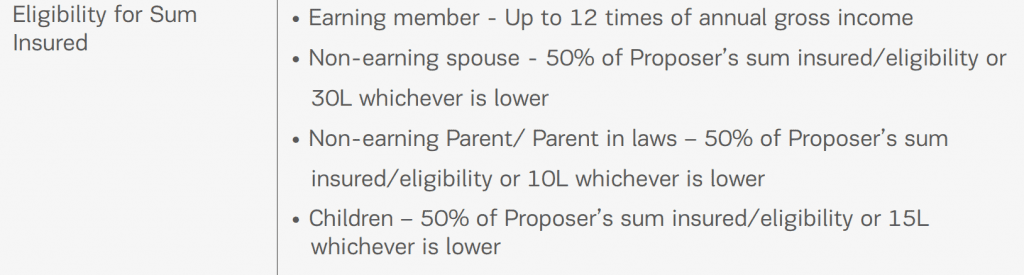

Of course, this is subject to 12 times annual gross income of the primary insured as shown below. But even so, this would still make for a sufficient cover to compensate for loss of income.

Source: Activ Secure Critical Illness Plan brochure

#3 Payout could go up to 150% of sum insured

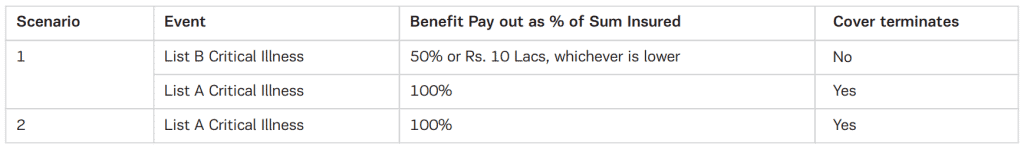

Like in all critical illness covers, a claim means the cover terminates and the policy is no longer renewable. This is what happens under Plans 1 and 2.

Under Plan 3 however, a claim under List B lets the cover continue. The cover ceases if a claim is made under List A, translating into a 150% SI payout. A first claim under List A also means the policy terminates and cannot be renewed. This plan allows for a maximum of 1 claim under List A and 1 claim under List B. Here is a look at the various scenarios under Plan 3.

Source: Activ Secure Critical illness plan Prospectus

This additional payout for List B illnesses could act as padding to one’s indemnity health cover in the event of one of the List B illnesses occurring before a List A illness.

#4 Attractive premiums for the breadth of coverage

The table below shows the premium under this plan for a cover of Rs. 10 lakhs including GST.

To put these numbers in context:

- HDFC ERGO’s Platinum option that covers 15 critical illnesses, charges a premium of ~ Rs. 4,000 excluding GST for a sum insured of Rs. 10 lakhs for a 31-35-year-old.

- Bajaj Allianz’ critical illness policy that covers 10 critical illnesses charges ~Rs. 3,000 (excluding GST) for a 26-35-year old.

- National Insurance Company’s critical illness plan comes at ~Rs 6,455 (including GST) for a 31 – 35-year old, under plan B covering 37 critical illnesses.

Activ Secure fetches you a wider coverage at a lower cost.

#5 Shorter survival period

All critical illness covers come with a requirement that the insured survive the diagnosis of the critical illness for a minimum period. This survival period is usually 30 days. The Activ Secure Critical Illness Plan however, comes with only a 15-day survival period. Given that the critical illness plan only kicks in when an illness is first diagnosed at a fairly advanced stage, the shorter survival period requirement raises the possibility of a claim and is an advantage.

What we don’t like

While there are some key advantages to Activ Secure Critical Illness, there are a few points that you need to bear in mind.

- The cap on sum insured: While the sum insured can go up to a crore, as mentioned above, it is capped at 12 times gross annual income for the earning member. Therefore, the policy may fall short for a young person at the beginning of his/her career. Our earlier article has some points that you need to bear in mind while arriving at how much critical insurance cover you need.

- Complexity: While this policy scores on the breadth of illnesses covered, the classifications under ‘List A’ and ‘List B’ with the latter attracting a lower sum insured makes this policy a tad complex in understanding the extent of claim you may be able to make. This is further exacerbated by a requirement that the List B illness has to occur first for the cover to continue for List A illnesses.

About the Insurer

Aditya Birla Health Insurance company Limited is the 5-year old health insurance subsidiary of Aditya Birla Capital Limited. A claims settlement ratio (by number of claims) of 92.88% and a claim settlement efficiency ratio of 99.87% for the 9 months up to December 2021, gives potential customers the comfort that the insurer is capable of handling the claim, if ever one has to be made. Do take a look at our earlier article, ‘Which insurers settle your claims the best’ to get an understanding of the ratios and what they tell you about how insurers settle health insurance claims.

Suitability

If you are a mid-career person shopping for a critical illness cover with a wide coverage, Activ Secure Critical Illness should be on your shortlist.

- We prefer Plan 2 for the scope of coverage it offers.

- If you want some additional health insurance padding and are especially concerned about any of the items on List B, then you should look at Plan 3. But weigh this against the incremental premium that you will have to pay.

- If the limitation on sum insured proves to be a hurdle to the amount of cover you require, then consider building your own corpus to supplement, which is anyway a good strategy to adopt.

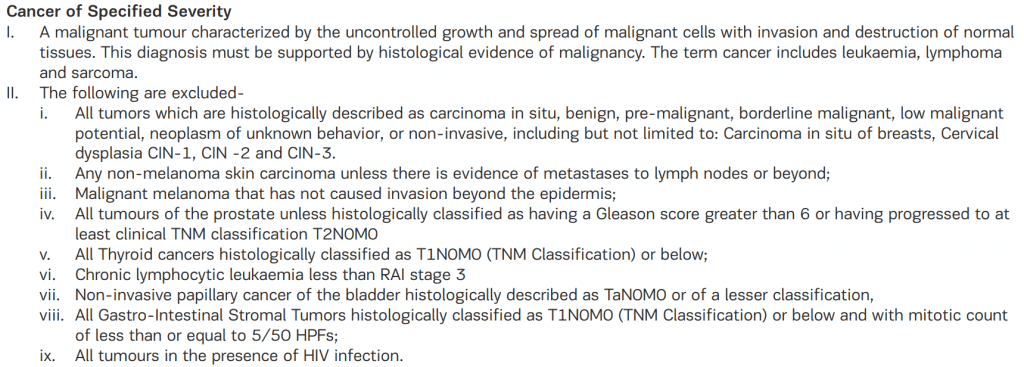

Do go through the fine print in the policy wordings and the list of permanent exclusions, if possible with your doctor, to see if there is anything that could work against you (in view of your personal medical history). Like with all insurance products, this is crucial. While the policy may cover a wide array of illnesses, they all come with conditions that have to be met. For instance, in this policy, a first-time cancer diagnosis has to meet all of the below conditions to be eligible for the claim. Similar criteria are in place for each of the illnesses covered.

Source: Activ Secure Policy Wordings

Important documents relating to this policy: Policy brochure, Policy benefit illustration, Policy wordings, Permanent exclusions, Prospectus.

Disclaimer: Please note that the above is only a review of the plan and not a recommendation. Please make a decision based on your requirements.