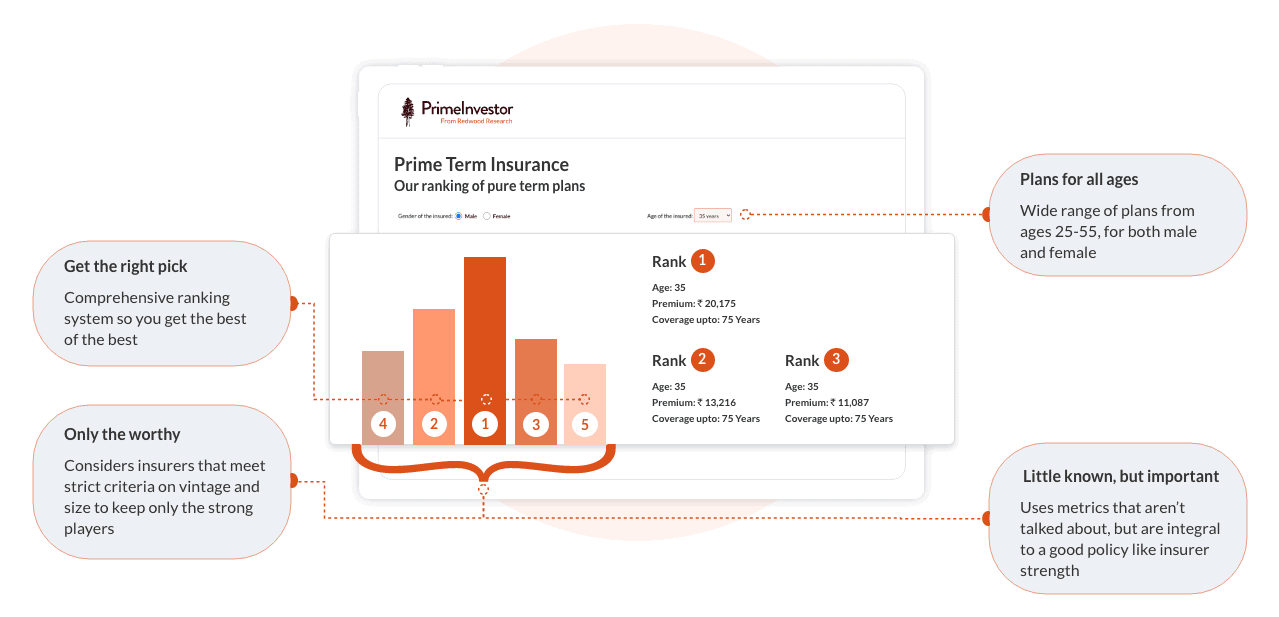

Prime Term Insurance Ranking

Term Insurance Ranking – Gating and Ranking methodology

At Primeinvestor, we think that a life insurance policy is a must-have protection product for certain kinds of income-earners. Pure term life plans do the best job of fetching you the maximum risk cover at an affordable cost.

Our Term insurance ranking will help you narrow down to the best term insurance plan suits your requirement.

Before you use our Term insurance ranking we would urge you to download our free e-book that will equip you with the following:

- Who needs term insurance

- Until what age you need to take a policy

- Options and add-ons that you can consider with your plan and those that you can skip

You should also check our super useful free term insurance calculator. This calculator gives you a practical way to approach your insurance cover rather than the arbitrary thumb rules that are often stated to cover your life.

Generally, it is best not to view insurance plans as investments. The insurance payout will be made not to you, but to your beneficiaries and an investment needs to be evaluated on multiple parameters – not just safety and tax efficiency, but also returns, flexibility and liquidity.

Let us discuss how we went about filtering the initial list of term insurance plans.

Gating criteria

Most folks, when presented with term plans from different insurers are inclined to go for the one with the lowest premium. But at Primeinvestor, we think that the ability and willingness of the insurer to settle your family’s claims in full, in the event of your death, is the most important attribute to look for.

As you are signing up for this product for 30/40/50 years, the key thing to look for is if the insurance company will be around and remain financially sound to settle your family’s claims. Private life insurance is also a relatively nascent industry in India, with a lot of churn.

We therefore first shortlisted insurers based on their pedigree, stability and financial soundness.

We used three elimination criteria to gauge these:

#1 Assets Under Management: The Assets under Management of an insurer shows the size of its customer base as well as investment book. After taking stock of the AUMs across the 24 life insurers in India, we used a minimum AUM of Rs 10,000 crore as the cutoff to make it to our shortlist. We used the AUMs from insurers’ latest public disclosures for this exercise.

#2 Solvency ratio: The biggest risk to any insurer’s survival is that it will receive a flood of claims that it is unable to service with its available investments. The Solvency Margin is a metric designed to ensure that this doesn’t happen.

It is the amount by which an insurer’s assets exceed its policy liabilities. Assets for an insurer usually consist of its investment book and fixed assets. Policy liabilities are the present value of future claims plus its own future expenses, minus the premiums it is likely to collect. Solvency Ratio is the insurer’s actual solvency margin measured against the required margin.

IRDA prescribes a minimum Solvency Ratio of 1.5 times for insurers in India. To ensure a more comfortable cushion, we applied 1.8 times as a cutoff on solvency ratio.LIC has a lower ratio, but we made an exception for it, as its policies are sovereign-guaranteed. Solvency ratios are again sourced from the latest quarterly disclosures of insurers.

#3 Vintage: To be doubly sure, we only considered insurers who have successfully completed at least 10 years of operations in India.

Applying these three elimination criteria left us with 14 life insurers in our shortlist. Primeinvestor’s term insurance rankings only cover the pure term plans of these 14 insurers.

Ranking criteria

The next step after filtering was to rank the universe of plans. Rather than consider premium alone, we decided to use a mix of stability, size, claims settlement and premium metrics and suitably weighted them to arrive at the ranking list. The weights were based on our assessment of how critical each metric is, in the decision of choosing a term policy. Here are the key metrics we considered:

- Solvency ratio (Times): The measure of how much cushion an insurer has in the form of assets to meet future liabilities. IRDA specifies a minimum ratio of 1.5 times. A higher ratio is better, but new and very small firms can sometimes show high solvency ratio because of the nascent stage of business. For this, we compile data from insurers’ quarterly public disclosures.

- Market share (%): Size confers disproportionate advantages in every financial business and more so in the insurance business where the size of premium income and investment book decide the financial strength of an insurer. Given that AUM has already been used as an elimination metric, we used an insurers’ market share in premiums for the latest financial period as a ranking metric. The market shares used relate to the insurer’s share in total premiums collected for the latest fiscal year-to-date information available.

- Persistency ratio (%): Insurance is one of the most mis-sold products in India. What’s more, it’s a product with very little flexibility for customers to exit, switch or otherwise vote with their feet. Persistency ratio, which measures the proportion of customers who have stayed with their policies for a specified length of time is thus a good proxy for an insurers’ service standards and its selling practices. We used persistency ratios at the end of 3 years and 5 years (37th month & 61st month) given the tendency of Indian insurers to see a sharp drop off in customer stickiness within 3 years. For the ranking, we use persistency ratios based on premium value from insurers’ public disclosures, for the latest fiscal year to date information available.

- Claims settlement ratio (%): This is the most important metric on which to gauge a life insurer. To give this metric adequate significance, we have used claims settlement ratios both based on number of claims settled and value of claims settled.Given controversy about calculation of this ratio, we sourced the claims data submitted by insurers to IRDA and disclosed in the latest IRDA annual report.

- Management risk: A change in the ownership or management of an insurer whose policy you’ve bought can mean a period of uncertainty and possible changes in the key metrics (such as claims ratio, solvency and persistency) on which you’ve based your decision. To budget for this, we have negatively weighted insurers whose promoters/management/key shareholders are in talks for the sale of a substantial stake or those who are likely to consider such a sale in the near future.

- Annual premium (%): Buying a life policy entails making a lifelong commitment to pay premiums. It is therefore desirable that those premiums are cost-effective and competitive. We deliberately refrained from assigning a very high weight to premiums, because these are based on the card rates of insurers. The actual premium that customers shell out when they approach an insurer can differ materially from card rates based on their health and risk assessment. For the purpose of these rankings, we used the premium quoted by insurers (including GST) for a specific age and gender for online, direct purchases of term plans.

For comparability, we have compared premiums for the regular annual premium option (that is, you pay a yearly premium throughout the policy term), for a fixed insurance cover. The quotes are also for a final lumpsum payout to beneficiaries. Insurers offer other options on their menu – such as limited premium payment terms, staggered benefit payouts instead of lumpsum and rising cover, which you may opt for at your convenience. We have used age 75 as the default age for the end of cover, except where individual insurers don’t permit you to select this option.

Our final rankings for each age/gender are a culmination of normalised scores that combine all the above.

Subscribe today to get access to an unbiased, independent list of best term insurance plans that suit your requirement.

Other insurance tools you can use

- DIY Term insurance tool – subscriber only

- Term Insurance calculator – Free

- Life insurance glossary – Free

- E-book of term insurance – free on registration