We have talked about SIPs several times – about SIPs in debt funds, whether to invest in lumpsum or SIP, whether to use SIPs when switching from one fund to another, and more. Here’s answering yet another question that you often have in SIPs. And that is, should you daily SIP, weekly SIP or monthly SIPs? Which delivers better for you?

SIP frequency

Could upping the frequency with which you run your SIPs net you better returns? The primary aspect you look at in SIPs is that it helps invest across different market levels and therefore averages your investment cost down. If that’s the case, it follows that making very frequent investments will help capture more market volatility than just once-in-a-month investing.

Therefore, can you do better with weekly or daily SIPs compared to monthly SIPs? If your SIP investment amount is large, couldn’t you especially take the averaging aspect a notch higher?

Today we’ll explore this by looking into returns over various durations and other aspects related to managing investments.

How returns compare

To compare daily vs weekly vs monthly SIPs, we sliced and diced the past 15 years to see returns in different market cycles and different SIP periods. We have looked into:

- Three 5-year periods: Jan 2005 to December 2009, Jan 2010 to December 2014, Jan 2015 to December 2019

- Two 10 year periods: Jan 2005 to December 2014 and Jan 2010 to December 2019

- And one 15 year period: Jan 2005 to December 2019

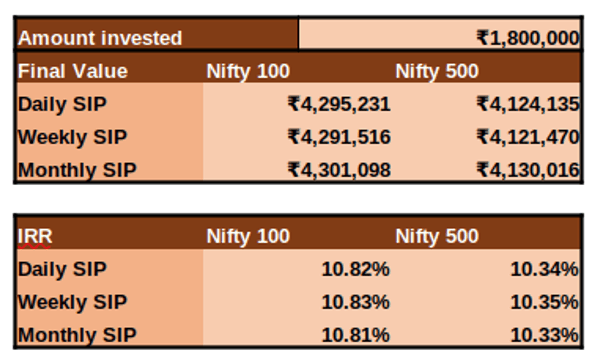

We ran SIPs in these periods on a daily, weekly, and monthly basis. We used two equity indices: Nifty 100 and Nifty 500 in order to remove fund-specific biases. The table below summarizes the returns (IRR) generated in each of these time buckets.

From the results of this analysis, the conclusion is this – returns do not vary significantly to declare a specific frequency as being superior. While stock markets are volatile, they do not swing widely enough on a day-to-day basis, and frequently enough to allow better cost averaging. This apart, the benefit of any day-to-day dips is usually compensated because investments are also made when markets tick higher on a day-to-day basis.

To put it in amounts, let’s say you ran a monthly SIP of Rs 10,000 in the Nifty 100 from Jan 2011 to December 2020. The total amount invested will be Rs 12,00,000. The value as of December 2020 will be: Rs 22,06,095.

If you replace the monthly SIP of Rs 10,000 with weekly SIP of Rs 2,298 so that total amount invested will remain Rs 12,00,000 itself, the final value as of December 2020 will be: Rs 22,06,413. That’s an advantage of just Rs 318 that the weekly SIP delivered over the monthly.

Now, if the monthly SIP of Rs 10,000 is replaced with daily SIP of Rs 484.26 so that the total amount invested will be Rs 12,00,000, the final value as of December 2020 will be: Rs 22,07,230. That’s about Rs 1,135 more compared to monthly SIP on a total investment of Rs 12 lakh.

There will be minor differences in the comparative returns based on the period under observation. But the bottomline is that:

- Stepping up frequency of SIPs does not provide any clear benefit to really debate whether a weekly SIP is better than a monthly SIP.

- When markets trend lower – which is when you can actually average costs down – a monthly SIP is adequate enough to catch that trend. If market corrections are short-lived, SIPs in any frequency are not going to help lower investment costs.

- If you wish to emphasize the impact of catching markets at lower levels, it’s best done through a few lumpsum investments using surpluses to supplement the SIP averaging.

It is true that we’ve just taken a few time periods to look at SIP returns. So, if you’re still not convinced and you wish to check other SIP periods and duration before making an opinion, use the spreadsheet from the link below.

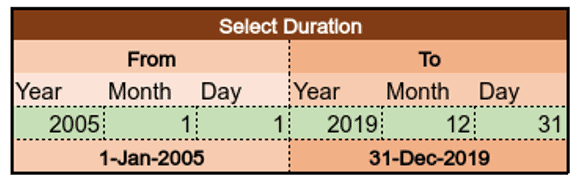

In the spreadsheet, set the ‘From’ and ‘To’ dates for analysis: For example: to select the period 01-01-2005 (1 Jan 2005) to 31-12-2019 (31 Dec 2019) for analysis, provide input as below:

Enter the monthly SIP amount in the appropriate cell provided and the total invested value, final value, and Internal Rate of Returns will be calculated and displayed as below.

The convenience aspect

If you’re enamoured by the slight gains you may get on weekly or daily SIPs and you’re willing to set your SIPs up that way, go right ahead. But if you’re still sitting on the fence, here are other aspects where monthly SIPs could score better.

- Monthly SIPs are easy to manage. Most salaried folks get paid once a month. Setting up a monthly SIP fits well with this. It’s easier to keep track of monthly debits instead of daily or weekly ones, and to ensure that there’s sufficient balance sitting in the account. We don’t have to keep track of how much cash will be debited throughout the month and how many instalments will be there in a month. For Weekly SIPs, instalments could be 4 or 5, for Daily SIPs, it will depend on the number of market days.

- Tax filing and portfolio managing could be simple with Monthly SIP: Once we redeem a mutual fund, we have to file capital gains in the tax returns. The capital gains will have to be calculated for each purchase. To keep track of costs and gains can be cumbersome as the number of purchases is more in Weekly and Daily SIPs. Similarly, keeping tabs on exit loads can also be hard.

- Only equity funds can see some benefit. It is only in equity where you have enough volatility to invest on lower levels. In most other categories, as we have explained earlier, SIPs don’t offer the scope to average costs. Nor do timing errors pose a significant risk. In these categories, very frequent investments could simply make the investing process more cumbersome.

Daily vs Weekly vs Monthly SIPs – Conclusion

The beauty of SIP is in its simplicity. The biggest benefit – as we say repeatedly – is that it promotes disciplined investing. Cost averaging and avoiding timing errors are secondary to this. In an effort to squeeze every last drop out of your investments, it’s best not to complicate things for yourself by adding more effort in managing your investments.

Of course, if you’re convinced that a monthly SIP is good to go with, your next question would be which date is best to run that SIP. Beginning of the month? Mid-month? Last week of the month? Well, we’ve done this analysis too, so we’ll answer this soon!