- One in three equity funds that have been in the top 2 quartiles for several years in the past have slipped to the bottom 2 quartiles over a period.

- If you invest in a top fund and don’t switch to a better fund while it slips in performance, your portfolio value can be hit significantly.

- Your portfolio does not need constant churn. It needs periodic weeding and regular review.

I read in many of the do-it-yourself investor forums that all you need to do is pick the right funds and just hold them. Their argument is that in the long term, since all fund performances tend to move to the mean, there is no real case for reviewing fund performance.

Should you buy and hold funds forever? We don’t think so. We think one needs to redefine buy and hold. Buy and hold is a great quality to have when you invest in equity funds. But patience does not mean putting up with prolonged underperformance. Buy and hold equity; but which funds to hold is a call to be taken. And that needs periodic review and some judgement. The need for active reviewing is important and cannot be overlooked. Let’s explain this with some data.

Point of no return

We took the 5-year rolling returns of equity funds for 10 years ending September 2019. That essentially means we took a 15-year period for this exercise. We split this 5-year rolling returns calendar-wise and ranked them every year.

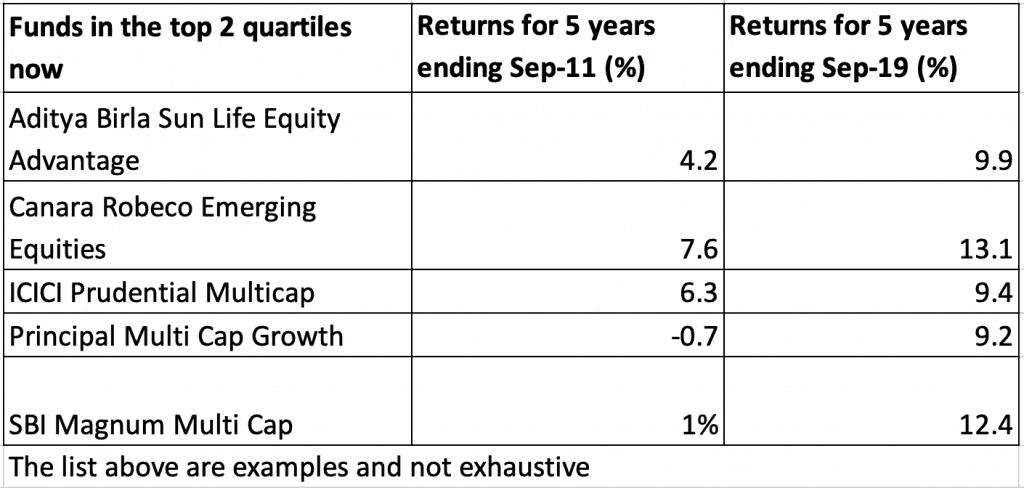

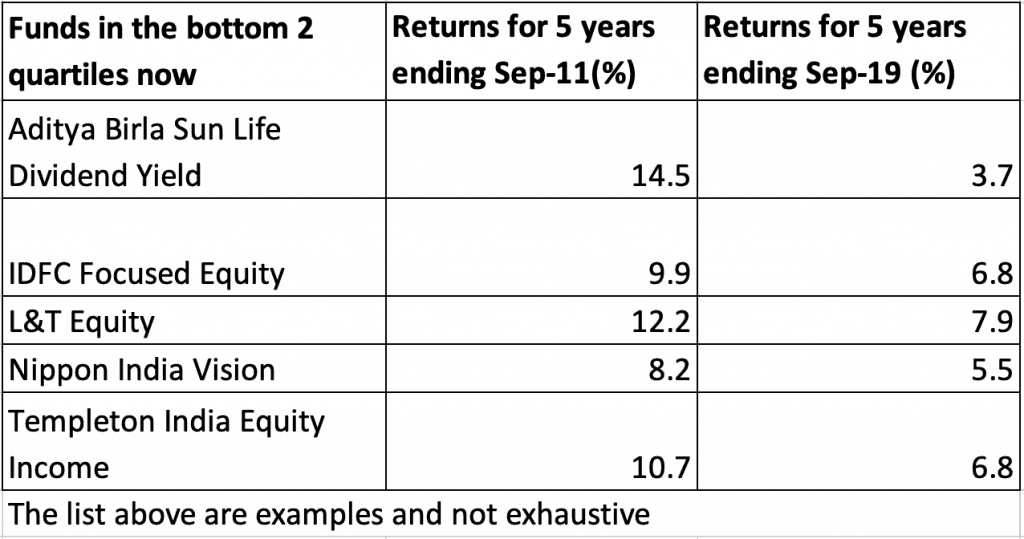

When we did this, one-third of the total universe of funds that were all in quartile one and two in rankings in 2009/2010, had moved to the bottom two quartiles by 2019. The reverse was also true. Those in the last 2 quartiles had moved up. Effectively, a ‘good’ fund did not always stay good and a bad fund found the ability to improve and deliver.

Great to gone

Aditya Birla Sun Life Dividend Yield (ABSL Dividend), Reliance Vision, L&T Equity, SBI Contra, Canara Robeco Equity Diversified, Templeton India Equity Income, UTI Dividend Yield, and IDFC Focused Equity are some other instances of yesteryear top performers now struggling to make a comeback.

ABSL Dividend, among the popular funds pre-2008 is a classic case of slipping due to prolonged underperformance of the dividend yield strategy (a strategy in which a fund manager invests in stocks where

dividend as a proportion of stock price is high). Some like IDFC Focused Equity saw a change in strategy and slipped. Others such as L&T Equity saw significant change in fund management, from Fidelity; while Reliance Vision saw a sharp spurt in inflows leading to challenges in pursuing its strategy.

On the other hand, funds such as ICICI Pru Multicap, Canara Robeco Emerging Equities, Principal Multicap, Aditya Birla Sun Life Advantage, that you would never have picked 8-10 years ago have been consistently in the top quartile of performance chart in the past 4-5 years.

When it matters

We now know that funds may not steadily stay where they are. So, what if some funds underperform? Should it matter to your portfolio? Two factors primarily determine whether you should bother with such change in fund rankings/ratings. One, what is your exposure to the fund that has been underperforming. Two, whether the fund fits your portfolio given your time frame.

Let us look at the first point. If you had, say, a 25% exposure to dividend yield or value funds (where fund managers buy quality stocks with depressed valuations) in the last few years, it would definitely hit your returns hard; but not if it accounts for, say, 5%. If a chunk of your portfolio is underperforming, it needs review and change, regardless of fund strategy or its suitability for you.

Impact of underperformance: Let us understand the quantum of the impact with a simple example of ABSL Dividend. If you had been investing Rs 10,000 per month in this fund from September 2011 (when it was ranked in top quartile), you would have Rs 12.6 lakh by end of September 2019; a return (IRR) of 6.4%. What if you had changed course say in 2015, when the fund was already languishing and switched to emerging performers such as Mirae Asset Large Cap? You will be surprised to know that your returns would have been double the Birla fund’s IRR at 13.1%. And in terms of wealth created, you would have Rs 17.2 lakh, a good 36% more than the wealth built with the other fund.

If you’re wondering if this is mere hindsight bias – it isn’t, really. Simple performance metrics would have shown you that ABSL Dividend was steadily underperforming while the Mirae fund was steadily coming up. Of course, this would have been possible only if you review, at least once a year.

Remember you do not hold a strategy because you ‘like it’. You hold it expecting it to deliver better than the market over time.

Not fitting your portfolio: Now let us take the second point on underperformance of a strategy. In the ABSL DIvidend example, one can argue that the dividend yield strategy did not pay off and hence the underperformance. The question is – how long would you wait for the strategy to bounce back? This is best answered with your own time frame. If you had, say, a 5-year time frame, and a value or dividend yield did not work for 3 years, then it needs to make a tremendous comeback in the next 2 years to deliver. The equation changes if you had a 10- or 20-year time frame. In short, strategy underperformance should not give you a false sense of comfort. Remember you do not hold a strategy because you ‘like it’. You hold it expecting it to deliver better than the market over time. And if you choose funds that don’t fit your time frame, the best thing is to correct it whenever you realise it.

Review a must

So, let us summarise the various reasons for underperformance and where you need to act: first, the classic case of strategy underperformance. Second, funds that may have garnered too much assets too quickly and are struggling to keep up the nimble performance they managed earlier. Three, change in fund house, fund management or change in styles that upset the fund’s performance rhythm. Four, simply

wrong calls by fund managers resulting in losses that are hard to recoup.

In the first reason, you need to take a very informed call on whether to continue or exit considering your overall exposure and time frame. All the other cases call for an exit after you wait for 3-4 quarters to see signs of pick up – either over benchmark or peers.

Continuing with underperforming funds compounds risks. One, there is an opportunity loss. Two and more importantly: when you invest for a specific goal, making market return assumptions, severe underperformance can throw your goals out of whack unless you identify the dip and course correct.

Buy and hold equity funds but be open to changing them when you must.