If there is one thing most have a soft spot for in the world of investing, it is an investment product that lets you save on taxes. So when we hear things like ‘tax saver mutual fund’ we immediately start to perk up, especially if this is close to the end of a financial year and we have to submit investment ‘proofs’ to the employer.

So, whether you know much about the Income Tax Act, 1961 or not, chances are that you will know about Chapter VIA that lets you deduct certain amounts in arriving at your total income. One such allowed deduction is contribution to ELSS mutual funds. Here we take a quick look at what these funds are and then at the pros and cons of ELSS funds.

What are ELSS Funds

Before we get into the pros and cons of ELSS funds, let’s take a look at what these funds are.

ELSS funds (short for equity linked saving scheme owing to its origins from the Equity Linked Saving Scheme of 2005) are a type of equity scheme as per Sebi’s categorization and rationalization of mutual fund schemes. This means that ELSS funds are essentially equity mutual funds, but are different from other equity fund categories as they come with tax benefits. Like equity funds, ELSS funds invest in stocks; most ELSS funds invest across large-cap, mid-cap and small-cap segments.

With a minimum investment of 80% in equity and equity related instruments, ELSS funds come with a lock-in of 3 years and tax benefits under Chapter VIA of the Income Tax Act. This explains why this type of funds typically see the most inflow during the month of March as shown in our earlier explainer on the best ELSS funds.

How can you invest in ELSS funds?

Investing in an ELSS fund is the same as investing in any other mutual fund. They are available via the direct or regular options. One can invest in them via the SIP or the lump sum route. You can use the same platform or distributor you use for your other mutual fund investments. An investor can also choose between the growth or IDCW options for ELSS funds.

Now let’s move on to the pros and cons of ELSS funds.

Pros and Cons of ELSS funds

The advantages of ELSS funds in the ‘pros and cons of ELSS funds topic’ are many, several of which overlap with those of other equity mutual funds. Here are the pros and cons of ELSS funds. We will start with the main benefits.

#1 The tax benefit

The first and possibly most well-known point to consider in the pros and cons of ELSS funds is the tax benefit they offer. Investment in ELSS funds qualifies for a deduction u/s 80C of Chapter VIA of the Income Tax Act. This deduction is available only in the financial year in which the investment is made and is subject to a maximum of Rs. 1,50,000 even if a larger sum is invested.

#2 Shortest lock in

Most tax saving investments come with a long lock-in period or maturity. The popular PPF account matures after 15 years. The Sukanya Samriddhi account matures on completion of 21 years. NSC deposits mature on completion of 5 years.

Compared to other investments that bring tax benefits, ELSS funds come with a relatively shorter lock-in of just 3 years which is big positive in the pros and cons of ELSS funds topic. This lock-in will apply to both lump sum investments as well as to each installment if investment is via the SIP route.

However, the lock-in of 3 years does not mean that you redeem your units at the end! You can stay invested for as long as you want after the completion of the mandatory lock-in period, and reap the benefits of being invested in equity for the long term. In this aspect, ELSS funds offer you the freedom to remain invested to allow returns to compound, and is a key pro in the pros and cons of ELSS funds.

In other tax-saving options such as NSC or bank FDs, you will necessarily receive your principal and interest at the end of the period and you will have to reinvest the same. This opens up two types of risk. One is reinvestment risk, which is that interest rates may not be as attractive compared to when you made the first investment. The second is that you run the risk of spending away that amount instead of ensuring that it stays invested!

#3 Equity advantage – better returns

Most tax saving investments prioritise safety of capital and therefore come with steady but limited returns. For more aggressive investors, locking away investments for the long-term in lower-returning products may not sit right! This is a key pro in the pros and cons of ELSS funds.

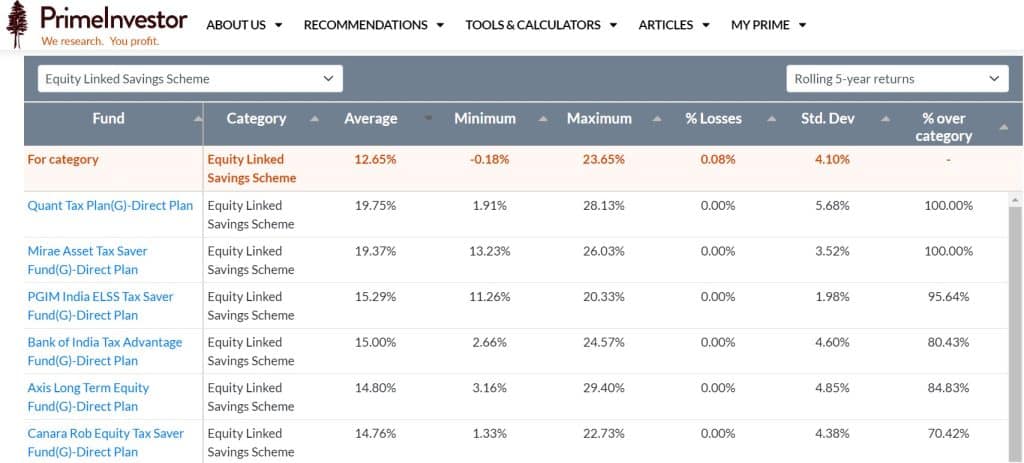

With ELSS funds, which are heavy on equity, you get the chance to boost your potential returns. Take a look at how ELSS funds as a category have performed with category-wise mutual fund returns data from PrimeInvestor. The image below, captured from this data, shows the average 5-year rolling return of ELSS funds as of end-July 2023.

Do remember, however, that equity markets are riskier and can fall steeply especially in short-term periods. While the lock-in ensures that you weather this short-term volatility, staying invested for a medium to long term horizon will help ELSS funds realise the long-term potential that equity offers.

Funds in the ELSS category are a varied set, which means that you can find a fund whose strategy complements the rest of your mutual fund portfolio or which meets your risk appetite. For example, if you are a more conservative investor, you can opt for an ELSS fund that invests primarily in large-cap funds. If you are aggressive, you can go for ELSS funds with mid-and-smallcap exposure, or which follow a momentum strategy or which are more dynamic and so on.

While ELSS funds seem like they can do no wrong, they do have some negatives. In this section of the pros and cons of ELSS funds, here are the main disadvantages.

#1 Multiple options

Weighing down ELSS funds in the ‘pros and cons of ELSS funds’ discussion is the eligibility of the investment in ELSS funds for a deduction is subject to the aggregate limit of Rs. 1,50,000 which includes all eligible investments covering items that fall under sections 80C, 80CCC and 80 CCD(1) and includes items such as life insurance premia, contribution to PF etc.

This means that you may have already hit the Rs. 1,50,000 limit with other eligible items. For example, you may find the Sukanya Samriddhi useful if you are saving up for your daughter’s education, or you may have a home loan, or perhaps sizeable EPF investments. ELSS funds are of no use to you and you are better off picking a fund from the larger universe that is more suited to your requirements and timeframe.

#2 New tax regime

With the introduction of the new tax regime, unless you opt for the old tax regime, investing in ELSS funds is not going to have any special advantage for you, though they do perform in the medium to long term. This is a key con of the pros and cons of ELSS funds. If the new tax regime makes more sense for you, then you are better off ignoring these funds. ELSS funds come with no market-cap based limitations, and are best be evaluated against flexi-cap funds. But since most AMCs run their flexi-cap funds and their ELSS funds similarly, you may be better off simply sticking to flexi-cap funds.

If you want to know how to go about planning your taxes and picking between the old and new tax regime, our article ‘Old vs New tax regime: Tax planning for 2023-24’ and our video on this topic will be of use.

#3 Underperformance

The 3-year lock-in also means that if a fund is not performing and you want to move it to another fund in the same category or if you just need the funds for any reason at all, your hands will be tied. This apart, you will have to track performance of the fund and shift to better options if the ELSS fund is not delivering better than its benchmark or other ELSS funds.

Here is a summary of the pros and cons of ELSS funds.

That sums up the pros and cons of ELSS funds.

How are ELSS funds taxed?

Taxation is part of the pros and cons of ELSS funds, but merits a deeper explanation. Aside from the deduction eligibility in the year in which investments are made, ELSS funds are taxed like equity-oriented funds. That means long term capital gains, where holding period is over a year, are taxed at 10% after Rs. 1 lakh and short term capital gains are taxed at 15%. IDCW payouts are taxed at the hands of the investor.

This places it at an advantage over tax-saving bank FDs and NSC, where interest is taxed at your slab rate and is a pro in the pros and cons of ELSS funds.

For a more detailed look at mutual fund taxation, including taxation of ELSS funds, take a look at our article ‘Understanding mutual fund taxation’ which is a part of Prime Varsity, our free investor awareness initiative, where you will find a wealth of resources.

How to pick the best ELSS fund?

Pros and cons of ELSS funds aside, if you decide to invest in ELSS funds, you will need to evaluate them like you would any other mutual fund by looking at factors such as:

- Consistency in performance

- Performance vis-à-vis peers and benchmark

- Volatility

- Ability to contain risks in a bad market

- Expense ratio

- Investment strategy

- Fund manager track record

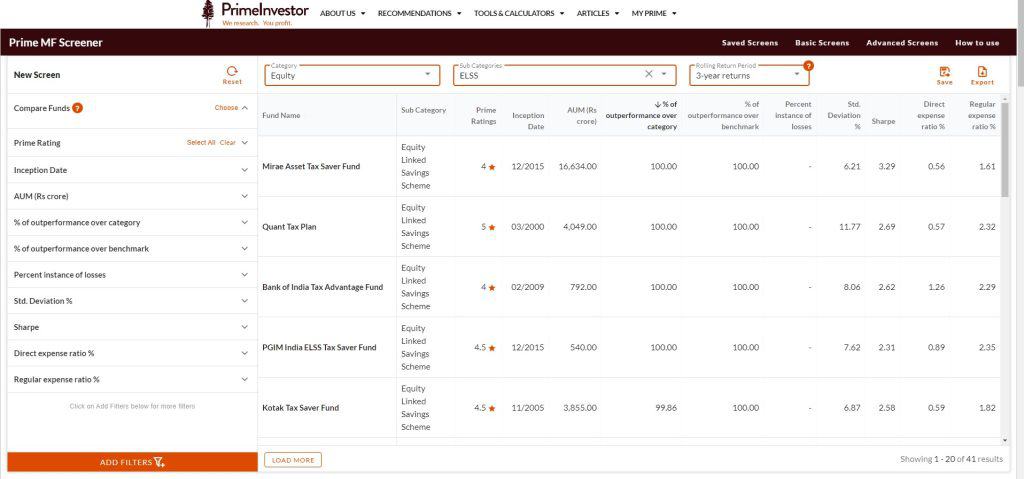

Our Prime MF Screener will help you pick a good fund. You can use most of the metrics mentioned above to filter funds in this tool. The image below will give you an idea of how the MF Screener can help you shortlist good ELSS funds.

You can also further evaluate ELSS funds using tools such as the MF portfolio overlap tool, Mutual funds rolling returns – category wise and Mutual fund expense ratio – direct vs regular to pick the best ELSS fund. You can also use our Prime Ratings as a first filter, to look at funds which score the best in terms of performance and then dig deeper to understand which fund is suitable for you.

However, even if you know all the pros and cons of ELSS funds, evaluating them may not be up your alley! Therefore, for those of you who need a little help, we have already crafted tax-saving portfolios for you. Head to our Ready-made portfolios where we have a special tax-saving portfolio that you can tailor to your needs. Not just that, our MF Review Tool will give you those funds which are a Buy, for your easy access.

In sum, while it is important to consider the pros and cons of ELSS funds, evaluate them as you would any other fund and keep in mind the points given above.