The demerger of Piramal Enterprises (PEL) was a long awaited one in the market. With sizable businesses in both financial services and pharmaceuticals, the demerger aroused significant interest among investors from a value creation point of view.

But the combined value of financial services and pharmaceutical businesses took considerable hit post demerger and gave a jolt to investors. In the quarter prior to demerger, promoters and institutions held 43% each in the company while FIIs held a lion’s share of 35%.

Just prior to the effective date of demerger, the stock or PEL was quoting at Rs.2,000 per share and at a market value of Rs.48,000 crore representing the combined the value of both the businesses.

As we write this article, PEL’s marktcap is at Rs 19,153 crore while that of the pharma stock (Piramal Pharma) is Rs 11,020 crore – totalling to Rs 30,173 crore. This is a 37% erosion post demerger. PEL is trading at Rs.802 per share while the pharmaceutical business (Piramal Pharma) is trading at Rs.92 per share.

So, what went wrong with the demerger math? We will look at this in detail by understanding where the two businesses stand now and what the future may hold for them. As it is now close to 10 months since the demerger came into effect, the standalone businesses reveal more now to provide clarity on what’s happening and what could be in store.

Demerger, also called Spin-off is a corporate action in which the business operations of a company are segregated into one or more components. This is mainly done to run businesses separately and in a focused way if their businesses and capital requirements are different. This provides benefit of reaping the right valuation for each of these businesses while meeting their capital requirements based on their own merit. Investors can also make a choice to invest in the business they like. Demergers are also done as a part of succession planning.

According to legendary investor Peter Lynch, spin-offs of divisions or parts of companies into separate, freestanding entities often result in astoundingly lucrative investment opportunities.

One of the demergers that created phenomenal wealth for shareholders in India was that of the demerger of Bajaj Auto in 2007. This resulted in the birth of Bajaj Auto, Bajaj Finance, Bajaj Finserv and Bajaj Holdings and all the companies multiplied wealth for investors. The one in news, Adani Enterprises, was another that spun-off businesses after incubating them.

Other demergers that created substantial wealth include Sundaram Clayton’s demerger of Wabco India, TCI group’s demerger of TCI Express, ABB’s demerger of power products business (now Hitachi energy), Tube Investment’s demerger of manufacturing business into TI India and Max group’s demerger of Max healthcare.

About PEL Demerger

PEL decided to demerge its pharmaceutical business into a separate entity named Piramal Pharma Ltd (PPL). Under the demerger scheme, four fully paid-up equity shares of PPL of Rs 10 each were issued to PEL shareholders for one fully paid-up equity share in PEL with face value of Rs 2 each held by them.

The demerger became effective from 30th August 2022 (ex-date) with PEL commencing trading as a pure financial services company. PPL later got listed on 19th October 2022.

About the Piramal Group

PEL founder, Ajay Piramal, was born in a business family that owned Morarjee Textiles Mills in Bombay, run by his father Gopikisan Piramal. In 1979, his father passed away, putting the reins on his and his brothers’ Dilip and Ashok’s shoulders. Dilip Piramal, the eldest, soon separated to run VIP Industries. The textile businesses went to Ashok Piramal group in a family split in 2005.

The turning point for Ajay Piramal came in 1988, when he bid for MNC pharma, Nicholas Laboratories. In the next two decades, the business grew to become the third largest pharmaceutical company in India before it sold the generic business to Abbott Laboratories in a $3.7 billion deal (Rs.17,500 crore) in 2010. It included an upfront payment of $2.12 billion, with an additional $400 million annually for the next four years. After paying related taxes and doing buy-back for 1/4th of initial consideration, the remaining corpus was retained by the company.

While this was done, Piramal group still retained other smaller parts of its pharmaceutical businesses. Meanwhile, Ajay Piramal also acquired Gujarat Glass in 1984 and renamed Piramal Glass. This was later sold for $1 billion to PE Blackstone in December 2020. Ajay Piramal also took an opportunistic investment call in Vodafone in 2012 for a short stint and exited with 52% returns for $1.4 billion in a matter of 2 years.

This cash kitty gave birth to Ajay Piramal’s new innings in financial services and that grew larger with the acquisition of DHFL in September 2021. PEL also holds 10% stake in Shriram Capital, the holding company of Shriram Finance.

The latest corporation action was the demerger of PEL into two businesses. It also seems to be a part of the succession planning of the group with Ajay Piramal’s son Anand Piramal taking the lead at PEL and Nandini Piramal taking the lead at PPL.

(On the periphery 😊 Mukesh Ambani’s daughter Isha Ambani is married to Ajay Piramal’s son Anand Piramal. Ajay Piramal also sits in the board of Tata Sons).

What went wrong with these businesses?

#1 Piramal Enterprises (PEL)

PEL’s core lending business was mainly in financing large real estate projects (wholesale lending) until it acquired the retail home loan business of DHFL. In the first quarterly result post demerger (September 2023 quarter), PEL reported a net loss of Rs 1,536 crore mainly on account of additional provisioning. PEL has moved Rs 5,888 crore worth of wholesale assets (large lumpy loans) from Stage 1 to Stage 2 as the management believed there could be potential stress from these assets. As a result of this asset recognition move, the company had to make significant provisions that dented its profitability.

Consequently, in the next 3 months, the stage 2 + stage 3 AUM jumped to over Rs.12,000 crore in Q3FY23 before coming down in Q4FY23 after sale to asset reconstruction (ARC) companies.

Note: According to the asset classification norms that NBFCs have to follow, Stage 1 assets consists of loans overdue for up to 30 days, stage 2 consists of loans overdue for 31-89 days, and stage 3 consists of loans overdue by more than 90 days.

The other issue that PEL had to deal with in the last one year was the increasing cost of funds after a sharp increase in interest rates. PEL’s book is half wholesale and half retail, and the retail book is the DHFL book. Cost of funds averaged 8.6% in FY23 while the yield on loans was at 12%.

Asset quality woes, high share of wholesale book in AUM, rising cost of funds and higher reliance on bank borrowings took a toll on the stock price in the last 9 months.

The stock fell from Rs.1,130 on the ex-date to Rs.802 now.

#2 Piramal Pharma Ltd (PPL)

The quarterly numbers post the demerger (September 2023 quarter) disappointed PPL shareholders as profitability was far below expectation. Weak financial performance combined with heavy reliance on debt took a toll on the stock price in the last 7 months.

In the next quarter (ending December 2023), it threw another surprise by reporting higher loss. Sharp margin contraction combined with significant interest and depreciation costs hit profitability.

Besides profitability woes, the company’s revenue at Rs.7,082 crore and EBIT of Rs.223 crore on a fixed asset base (including goodwill) of Rs.8,887 crore and capital employed of Rs.11,565 crore suggested underutilisation of capacities or problems with scaling up. This apart, PPL also had capex plans of ~Rs.1,000 crore for FY23, which added to investors worry. From Rs.200 on listing date, the stock fell to a low of Rs.64 before settling at Rs. 92 now.

Where the two companies stand now

#1 PEL - trying to improve yield

Here’s a quick look into the key numbers at a glance the end of FY23

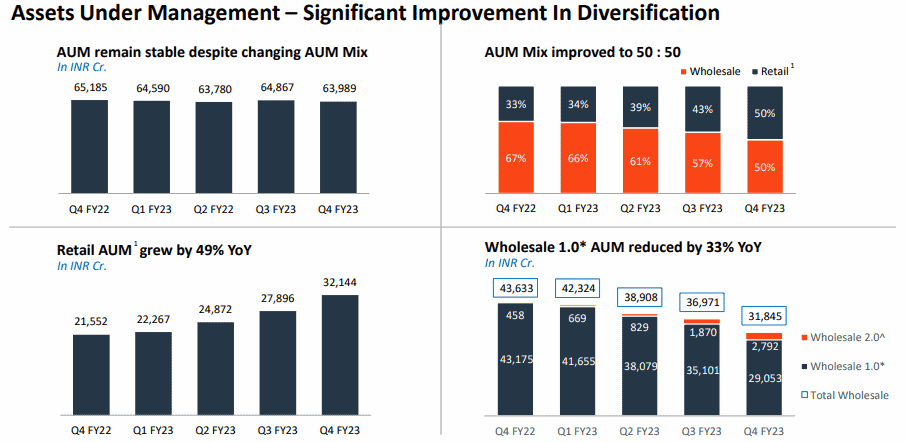

The year FY23 has been one of course correction and restructuring for PEL to chart its long-term growth trajectory. It focused on trimming down its wholesale book while finding out newer opportunities in the retail lending beyond housing finance acquired through DHFL. While the AUM hasn’t changed much in the last one year, the composition has undergone a big change.

Here’s a quick look into the AUM evolution in the last one year.

Source: Company presentation for Q4 & FY23

The whole sale book has been classified as Wholesale 1.0 & 2.0 with 1.0 comprising of the legacy book skewed towards lumpy real estate developer loans and 2.0 comprising of more granular book comprising real estate and mid-sized corporate loans with average ticket size of Rs. 55 crore.

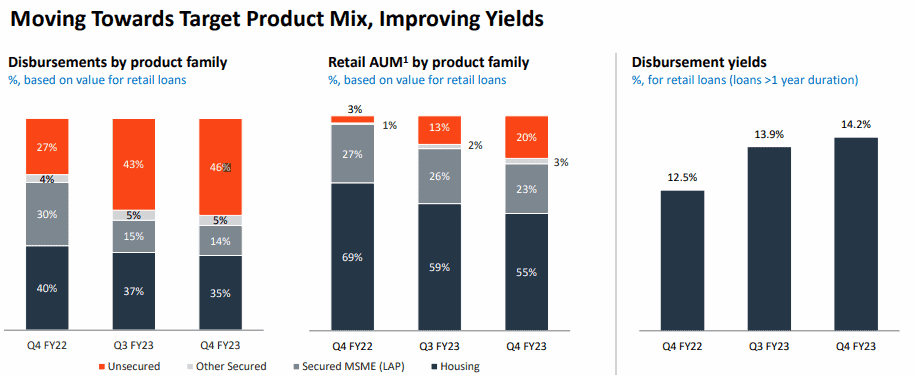

Breaking down the retail book further, PEL is now focusing more on high yielding segments including unsecured loans. PEL is consciously moving its retail book towards high yielding AUM, though it carries risk, to generate higher RoA and RoE. The change in mix has also led to retail book yields improving from 12.5% at the end of FY22 to 14.2% at the end of FY23.

Source: Company presentation for Q4 & FY23

#2 PPL – niche businesses but still struggling

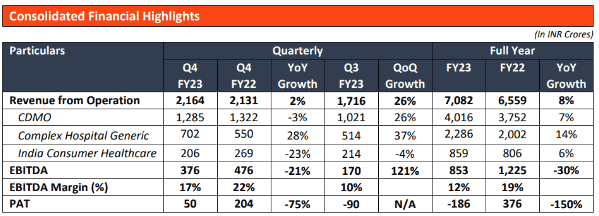

Here’s a quick look into the key numbers at a glance at the end of FY23.

PPL is a differentiated pharmaceutical business with a niche business mix comprising CDMO, complex generics and OTC products. It exited its generic drug business way back in 2010.

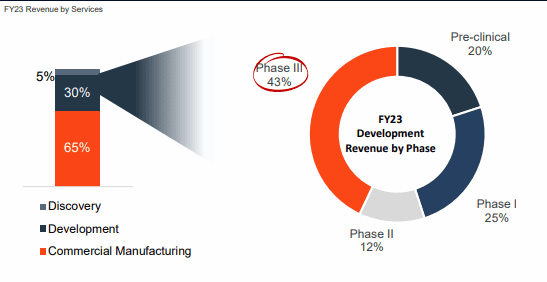

To explain further on business segments, CDMO is the largest business segment contributing to over half of its sales within which 5% comes from discovery services (like Syngene) while majority of the rest comes from development and manufacturing (like Divis, Suven). It has USFDA compliant facilities both in India and abroad to take up assignments closer to where its customers are.

Further break-up of development revenue shows that 43% of revenue is from drugs in Phase-III trials which will open further opportunities for manufacturing in future if they enter commercialisation.

Source: Company presentation for Q4 & FY23

Hospital generics comprising anaesthesia products is the second major vertical contributing to a third of its revenue and this is a high entry barrier business.

Remaining is contributed by the OTC products in India comprising brands such as Saridon, Lacto Calamine, Littles, Polycrol, Tetmosol and I-range. OTC business is in the process of scaling up with significant investment going into brand building and is yet to reach break-even.

Here’s a break-down of segment-wise business revenue for last two quarters as well as for FY23.

Source: Company press release

Note: Management has not given segment-wise margins. Barring the OTC business, other business segments are profitable.

Despite being in niche businesses, the profitability took a plunge in FY23 Vs FY22. Underutilisation of capacities in the CDMO business and operating losses in OTC business seem to be hurting its performance.

Over several years now, PPL has also done several acquisitions in US, Europe and in India and stitched them together to make CDMO a sizable one. Meanwhile PPL also received $490 million (Rs. 3,500 crore) in equity funding from PE Carlyle for a 20% stake in October 2020.

PPL has done close to Rs.1,000 crore of capex in FY23, mainly towards the expansion of its facilities in US and Europe and in Ahmedabad.

What’s the road ahead for these businesses?

#1 PEL – less negative surprises going forward

PEL seems to have proactively taken a clean-up of its wholesale book in FY23. Since it had sold some of its assets to ARCs at an over 60% discount, there may not be any major negative surprise coming from it.

High capital adequacy of 31% and Investments valued at Rs.6,200 crore in Shriram Group are key positives to highlight. Shriram Group Stake itself is a third of current market value.

As explained above, PEL’s ultimate objective is to achieve an AUM mix of 2/3rd retail and 1/3rd wholesale from the 50:50 mix at the end of FY23 to in turn achieve 2.5-3% RoA and mid-teen RoE. The retail book plan comprises of increasing branch count from 400 to 600 and then leveraging the network to offer products like Loan against property (LAP) and MSME loans to diversify beyond housing finance. Its unsecured book is also growing through fintech tie-ups.

All these initiatives should help it improve its yield on advances while not compromising on asset quality to achieve its RoA and RoE objectives.

In FY23, PEL’s cost of funds stood at 8.6% while its yield on AUM stood at 12% and NIMs at 5.8%.

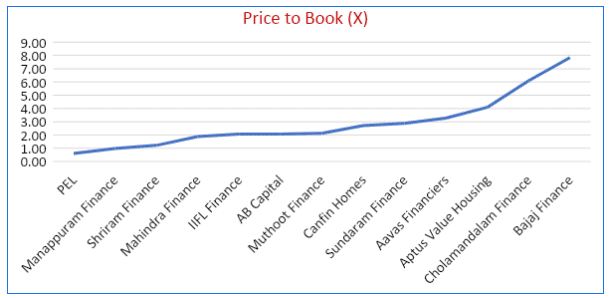

Let’s also try to understand from other NBFC valuations on where PEL can head on the valuation curve as it improves on various parameters.

If PEL can achieve its objective of 2.5 – 3% RoA and mid-teens RoE, it can gradually move from 0.6 times book value to 1.5 to 2 times book value in the lines of NBFCs such as Mahindra Finance, IIFL Finance and Aditya Birla Capital (AB Capital).

PEL is more likely to achieve key financial metrics such as RoA and RoE closer to these players while it is unlikely to achieve the superior metrics of players like Cholamandalam Investment and Finance and Bajaj Finance.

PEL’s transformation from hereon could closely resemble the transformation achieved by AB Capital from a corporate heavy lender to retail lender over the last few years.

In FY23, AB Capital managed 2.45% RoA and 14.76% RoE in its lending business with NIM of 6.84% on an AUM of Rs. 80,556 crore. Its cost of funds stood at 7.25%. ABFRL’s housing finance business also reported close to 2% RoA and 13% RoE in FY23 with NIM of 5% with AUM of Rs.13,800 crore.

PEL’s destiny could also be decided by what role (if any) destiny holds for Anand Piramal in the Reliance group.

#2 PPL – better utilisation key to profitable growth

PPL is hopeful of profitable growth in FY24 after seeing recovery on order inflows, better business mix and profitability in Q4FY23. During the year, it has successfully cleared 36 regulatory inspections including 4 US FDA audits at its overseas sites at Riverview, Lexington and Sellersville in US and Digwal in Telangana. These five sites which have passed the audit contributed more than half of the CDMO sales in FY23, which indicates less hurdles to future growth.

PPL has also announced a rights issue of Rs.1,050 crore to keep its debt under check while funding its capital expansion plans. It has filed necessary papers with SEBI for approval and is expecting to complete the issue in the first half of FY24.

For PPL, the key challenge going forward will be to scale up utilisation of capacities, deliver on operating performance, bring down debt and showcase a clear path to profitable growth.

As mentioned earlier, PPL is challenged with underutilisation of capacities and problems with scaling up. The early signs of revival should come from accelerated sales growth (especially in its CDMO business) combined with strong margin performance (20%+) to take RoCE back to double digits on this bloated capital base. But this is not an easy task to achieve, especially to deserve the valuation that the market affords for niche companies in this space.

For now, the only compelling part is its compliance track record in its CDMO business that keeps the hopes alive.

In general, Q1 is not a strong for CDMO business after a strong Q4 and so upcoming Q1 may not give clear indications of recovery. It may have to be seen in subsequent quarters.

For investors, the one important factor in favour is the strong hand of promoter in both these businesses. The challenges appear to be similar for both – to deliver on financial performance with visible improvement in each quarter, leading to a gradual re-rating in valuation. A group to be watched!

The securities quoted are for illustration purposes only and are not recommendatory.