The thematic category of equity funds doesn’t house just sector-based funds or themes such as manufacturing or transport or consumption. The category also features funds that are just diversified equity funds investing across sectors and market caps, but which have an underlying theme that ties together these stock & sector choices.

One of these is ‘Opportunities’ funds. Opportunities funds pick sectors and stocks that are in special situations (such as restructuring, mergers etc.) or which are turning around or which can benefit from a change in policy or regulations and so on. Unlike, say, consumption or banking funds, these funds do not restrict themselves to a limited universe of sectors or stocks.

Our Prime Funds features two such ‘Opportunities’ funds, under the Equity Aggressive category – ICICI Prudential India Opportunities Fund and Franklin India Opportunities Fund. In this report, we explain why these two funds are a good portfolio addition.

What are ‘opportunities’ funds?

There is no real definition of an ‘opportunities’ fund. Several equity funds from the standard equity categories like to add in this word in their names, such as ‘mid-cap opportunities’, ‘emerging opportunities’ and so on; these funds just be a midcap fund or a multicap fund and so on. Therefore, here are the points to note about opportunities funds:

- When we refer to opportunities as a theme, we mean the thematic equity fund category. With SEBI’s categorization rules in 2017 that restricted AMCs to one fund per equity fund category other than index & sector/thematic, AMCs began using the thematic category to launch diversified equity funds with differentiated strategies. The ‘Opportunities’ strategy is one of these.

- There is no strict rule on what constitutes a special situation or a regulatory change impacting sector prospects and the like that can translate into a opportunity. Therefore, each fund can differ in how it assesses different sectors and opportunities.

- Given that these funds can invest across sectors and marketcaps, their performance needs to be compared to flexicap or multicap funds, depending on their marketcap profile. Their portfolios and strategies also need to be similarly compared as flexicap/multicap funds can well follow a strategy of picking stocks out of market favour or sectors which are in different stages of growth.

- A key positive in some opportunities funds – especially ICICI Pru Opportunities and Franklin India Opportunities that we have recommended above – is that they can be entirely benchmark-agnostic. That is, they do not tie themselves to the sectoral or stock weights of their benchmark index and can go heavily overweight or underweight. This enhances the upside that can be captured if the stocks take off much more than with other funds – barring a few, flexicap funds don’t deviate very significantly from benchmark sector weights. This makes opportunities funds differentiated from these standard equity funds and good portfolio diversifiers.

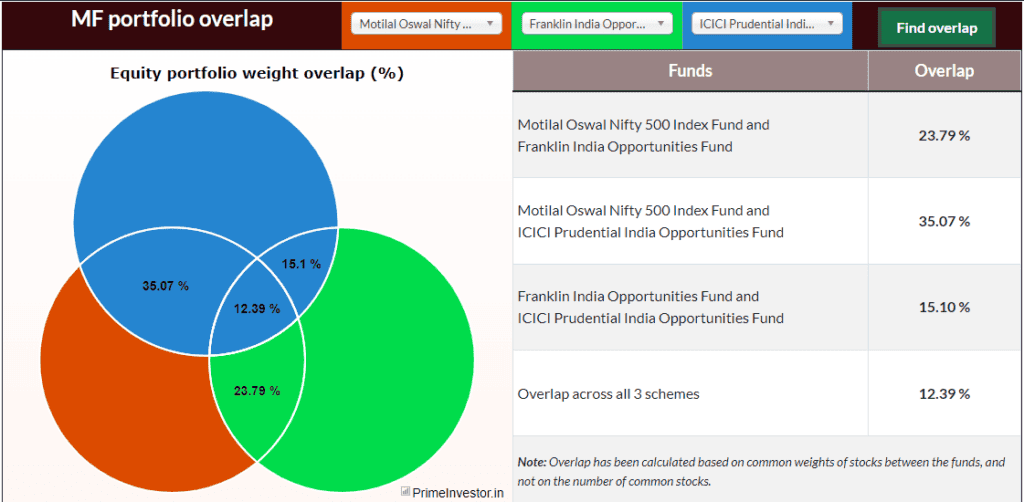

For example, the image below from our MF Overlap Tool captures the overlap between the Nifty 500 (represented by the Motilal index fund), Franklin India Opportunities and ICICI Pru India Opportunities. As you will see, the overlap between the index and the fund is low.

Franklin India Opportunities

We added Franklin India Opportunities (Franklin Opportunities) in our September 2023 quarter review. The fund does not have a very strong historical performance; on a rolling 1-year return since 2020, the fund has beaten the Nifty 500 index only about 60% of the time (its uneven performance along with higher volatility has contributed to its current low Prime Rating despite it appearing in our Prime Funds list).

However, the fund’s sector and stock calls made earlier held it good stead to participate well in the market rally that took off last year. For example, Franklin Opportunities picked up defence early in 2022 which has helped it ride the wave well. Similarly, calls taken in auto ancillaries in mid 2022 have since paid off, as have smaller industrial plays.

The fund began outperforming the Nifty 500 in early 2023 and is now beating the index by a solid margin of over 30 percentage points. Its average 1-year return based on rolling returns since 2020 stands at 26.6% against the Nifty 500’s 20.1%.

The fund has since booked profits and scaled down on these sectors, instead picking up those such as consumer durables and pharma. It has also retained focus on engineering companies and has slightly increased banking weight as well, though banks are not a heavy sector weight. These allocations can work well in the current market scenario.

Franklin Opportunities also rode the smallcap wave extremely well, upping smallcap exposure over the past two years. The mid-and-smallcap allocation stands at about half the portfolio. The fund can also move into cash; it held an average of 10% in cash in mid-2022, deploying it back towards the end of 2022 just before the head mid-and-smallcap rally took root.

Franklin Opportunities holds a larger portfolio of stocks with lower weights to individual stocks. Its benchmark-agnostic approach can be seen in its top few holdings, as shown in the table below. Franklin Opportunities is, however, a highly volatile fund and can fall as much as the index during downturns. Its smallcap allocation also makes it a high-risk bet.

ICICI Prudential India Opportunities

The ICICI Pru India Opportunities fund was launched in 2019 and to this extent doesn’t sport a very long track record. But owing to its differentiated portfolio and improving performance, we added it to Prime Funds way back in September 2021 without waiting for a longer track record, under Equity Aggressive category.

The fund has been a consistent performer since inception, beating the Nifty 500 TRI a good 76% of the time on a rolling 1 year return and all the time on a rolling 3-year return basis. The fund also captures upsides very well. It can be more volatile than other diversified equity funds, but its strong outperformance has helped it clock in a higher Sharpe.

ICICI Pru India Opportunities is similar to ICICI Value Discovery in its value-based approach. It made timely calls in sectors such as pharma, automobiles, oil & power, and even IT and telecom, in the past 2-3 years that aided its strong outperformance.

The fund has, however, pruned much of this exposure to pocket the gains and has instead turned to more up-and-coming opportunities. These include FMCGs that are emerging from subdued volume growth and other consumer plays, insurance which has been out of market favour, and banking that has come out of a cyclical downturn and a good credit environment. These can work well in the current market scenario. The top stocks it holds current is in the table below.

ICICI Pru Opportunities tends towards a more concentrated approach; while it can hold upwards of 40-50 stocks, the top ten have larger weights and can account for up to half the portfolio. The fund does not shift around allocations much, leaning towards a more buy-and-hold approach. It holds more large-caps in its portfolio over mid-and-smallcaps, but has yet managed to beat the Nifty 500 by a good margin.

Which one to invest in

You may, of course, wonder which of the two you should invest in. Here are a few pointers:

- Franklin India Opportunities is by far the more aggressive fund. Go for this if the mid-cap/small-cap allocation is lower in your portfolio or you are looking to up the risk-return component in your portfolio. The fund shares low portfolio overlap with other Equity Moderate and Equity Aggressive funds in Prime Funds and can thus be a diversifier in any portfolio.

- ICICI Pru India Opportunities is a more value-based fund. This fund can be added to any portfolio, since it is more balanced between large-caps and mid-and-smallcap funds. However, if you hold ICICI Pru Value Discovery in your portfolio, it’s best to skip the India Opportunities fund as both share a similar strategy and relatively higher overlap.

- Avoid making very high allocations to these funds, especially to Franklin India Opportunities. If you go with the Franklin fund, it should form part of, and be within, your overall allocation of mid and small-cap funds. A turn in market favour for the more cyclical sectors that these funds bet on and the wide deviation with the benchmark can exacerbate any underperformance.

15 thoughts on “Prime Fund Recommendation – Two ‘Opportunities’ funds to add to your portfolio”

Thanks for the article the mf review tool has a rating of 2.5 with a buy any specific reason why 2.5 for franklin

We club such thematic funds that invest across sectors/stocks along with the comparable flexicap/multicap/largecap category and then rate. Franklin Opportunities has seen earlier periods of underperformance against the Nifty 500, which is reflecting in its rating. We use additional qualitative metrics along with seeing performance trends etc and not just the rating alone when we give recommendations. – thanks, Bhavana

Thanks Bhavana -understand your explanation. Will go for Franklin and not ICICI. I Have already good exposure on Value fund. DNA.

How such thematic funds fit in the portfolio of “prime growth” subscribers who also invest in stocks? Won’t prime stocks give superior returns compared to any thematic fund you are recommending?

for example, if I am targeting 45:15:40 prime portfolio:prime stock: debt allocation then should I try to fit in such thematic funds in 45% allocated for prime portfolio? If yes then how much % of total portfolio it should be?

I have gone through https://www.primeinvestor.in/varsity/how-you-should-use-sector-funds/ and it mentions that

“Finally, if you own a direct stock portfolio outside your mutual fund portfolio, diversified thematic funds will offer a good foil.”

I think “good foil” means a diversifier. Can you please explain?

Thematic funds can be used to increase return of your mutual fund portfolio itself, even if you also have stocks. You don’t need to choose between stocks and thematic funds. Sector/themed funds can be used to zero in on a particular market trend and play it across – this may be harder to do with stocks since you will typically be able to invest in only a few. To this extent, thematic funds are a good portfolio diversifier. They are also especially useful in large portfolios. – thanks, Bhavana

Thanks Bhavana for these insights. It would be great to have a series of articles on how to navigate so many theme based NFOs in an already established portfolio or for a new investor as well

Thank you! Will consider your suggestion on explaining thematic funds. You can check this article on using sector funds in general: https://www.primeinvestor.in/varsity/how-you-should-use-sector-funds/ – regards, Bhavana

Since these are thematic how does it differ from a business cycle fund (which plays on sectoral rotations) or a thematic FoF (ICICI has it) and why should one not go for these as compared to opportunities fund ?

They are all comparable, really. Business cycle may be more top-down looking at sector trends than opportunities funds, which can be more stock-specific. It doesn’t have to be one or the other – at their core, they are all simply normal equity funds investing across sectors/stocks based on some strategy. So their performance needs to be clubbed together and looked at, along with the diversified equity funds (flexicap/value/multicap etc) – and not in isolation for each type. That’s what we do…so based on that we pick among thematic funds. We don’t recommend thematic FoF – it doesn’t give you control over which theme to pick and when, and it is tax-inefficient compared to holding pure equity funds. regards, Bhavana

Should we invest in Lumsum or x chunks or SIP preferred ?

Any route is fine – the fund is not tied to a specific sector or theme (unlike sectoral funds) and so catching the theme is not the key here. It is like investing in a flexicap or multicap fund. – regards, Bhavana

hi Bhavana,

Excellent analysis as usual !!

One question – can either of the fund be the only Thematic fund in our portfolio ? Since it actively rotates the themes, can we skip the Prime fund mentioned in Time based 7+ year portfolio and use one of these two?

No, it is not a replacement for a thematic fund. These funds invest across stocks & sectors – it is more like a differentiated flexicap/multicap type fund than a substitute for a specific sector/theme. But if you want to avoid sector-specific thematic funds, then these two opportunities funds are good portfolio diversifiers too. – thanks, Bhavana

What is the recommended percentage allocation of the opportunities fund in the portfolio?

That depends on your overall allocation to aggressive funds (those with midcap/smallcap orientation, sector funds) and the funds you hold. You need to treat these funds as aggressive funds and any allocation to make to these must keep your overall allocation to higher-risk funds within the limit you have set. So for example, if your portfolio can have 30-35% in aggressive allocation, you can assign, say, 5-10% to these funds. But if you have only, say, smallcap funds or high exposure to sectoral funds, then you can have a higher allocation to these opportunities funds as they will be comparatively lower on risk. There is no hard and fast rule on allocation. – thanks, Bhavana

Comments are closed.